With Understanding inflation at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Inflation is more than just rising prices – it’s a complex economic phenomenon that impacts every aspect of our lives. From the money in our pockets to the prices we pay, inflation plays a crucial role in shaping our economy. Let’s dive into the world of inflation and unravel its mysteries.

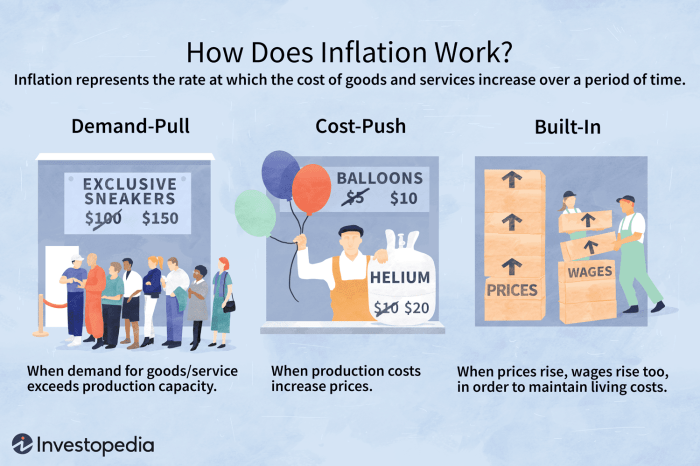

Definition of Inflation

Inflation refers to the increase in the overall price level of goods and services in an economy over a period of time. This means that as inflation rises, each unit of currency buys fewer goods and services.

Effects of Inflation on Purchasing Power

- Decreased purchasing power: When inflation occurs, the value of money decreases, leading to a reduction in the purchasing power of consumers. This means that individuals can buy fewer goods and services with the same amount of money.

- Impact on savings: Inflation can erode the value of savings as the interest rates on savings might not keep up with the rising prices of goods and services.

- Income redistribution: Inflation can affect different income groups differently, with fixed-income earners and lower-income households being more negatively impacted.

Causes of Inflation and Measurement

- Demand-pull inflation: This occurs when the demand for goods and services surpasses the economy’s ability to supply them, leading to an increase in prices.

- Cost-push inflation: When the production costs of goods and services increase, such as due to rising wages or raw material prices, this can lead to inflation.

- Measuring inflation: Inflation is commonly measured using the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track the average prices of a basket of goods and services over time.

Types of Inflation

When it comes to inflation, there are different types that can affect economies in various ways. Let’s dive into the main types of inflation and explore their impacts on different sectors.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the available supply. This leads to an increase in prices as businesses raise prices to meet the high demand. It is often associated with a growing economy and can result in higher wages and increased consumer spending.

Cost-Push Inflation

Cost-push inflation, on the other hand, happens when the cost of production increases for businesses. This can be due to factors like higher raw material prices, increased wages, or taxes. As a result, businesses raise prices to maintain their profit margins, leading to overall price inflation. Cost-push inflation can have a negative impact on consumers as their purchasing power decreases.

Hyperinflation

Hyperinflation is an extreme form of inflation where prices skyrocket uncontrollably. This can happen due to factors like excessive money printing, political instability, or economic crises. Hyperinflation erodes the value of currency rapidly, causing chaos in the economy and leading to a loss of confidence in the monetary system.

Impact on Economies

Each type of inflation affects different sectors of the economy differently. Demand-pull inflation can stimulate economic growth but may lead to asset bubbles and income inequality. Cost-push inflation can result in reduced consumer spending and slower economic expansion. Hyperinflation, on the other hand, can devastate economies, causing businesses to shut down, unemployment to soar, and savings to lose value rapidly.

Factors Influencing Inflation

Inflation is influenced by various factors that impact the overall economy. Let’s delve into some of the key drivers of inflation rates.

Monetary Policy

Monetary policy plays a crucial role in determining inflation levels. When central banks increase the money supply by lowering interest rates or implementing quantitative easing, it can lead to higher inflation as more money flows into the economy.

Fiscal Policy

Fiscal policy, which involves government spending and taxation, can also affect inflation. For example, an increase in government spending without a corresponding increase in revenue can lead to inflationary pressures due to excess demand in the economy.

Supply Shocks

Supply shocks, such as natural disasters or geopolitical events, can disrupt the supply chain and lead to inflation. For instance, a decrease in the supply of oil due to political tensions can cause oil prices to surge, leading to higher inflation rates.

Global Events and Trends

Global events and trends, such as trade agreements, currency fluctuations, or economic crises in other countries, can have a ripple effect on inflation rates. For example, a global recession can reduce demand for exports, affecting domestic prices and inflation.

Historical Examples

Throughout history, various events have triggered significant changes in inflation rates. One notable example is the oil crisis of the 1970s, where a sudden spike in oil prices led to stagflation – a combination of high inflation and high unemployment rates, showcasing how external factors can drive inflation.

Effects of Inflation

Inflation can have significant impacts on various stakeholders in an economy, including consumers, businesses, and governments. Understanding these effects is crucial in navigating the economic landscape.

Impact on Consumers

- Inflation erodes the purchasing power of consumers, meaning they can buy fewer goods and services with the same amount of money.

- It can lead to a decrease in real wages, making it harder for individuals to maintain their standard of living.

- Consumers may have to adjust their spending habits and prioritize essential items over discretionary purchases.

Impact on Businesses

- Businesses may face higher production costs due to increased prices of raw materials and labor, impacting their profit margins.

- Uncertainty caused by inflation can hamper long-term planning and investment decisions for businesses.

- Companies may need to adjust pricing strategies to account for rising costs, potentially affecting competitiveness in the market.

Impact on Governments

- Inflation can lead to higher interest rates set by central banks to control the money supply, affecting government borrowing costs.

- Governments may struggle to maintain social welfare programs and public services as inflation reduces the value of budget allocations.

- Fiscal policies aimed at combating inflation, such as austerity measures, can have social and political repercussions.

Effects on Savings, Investments, and Economic Growth

- Inflation diminishes the real value of savings over time, encouraging individuals to seek higher returns through riskier investments.

- Investments in fixed-income securities like bonds may suffer from lower purchasing power returns in an inflationary environment.

- High inflation rates can hinder overall economic growth by reducing consumer purchasing power and business investment.

Mitigating the Effects of Inflation

- Diversifying investments across asset classes can help protect against inflation risks.

- Indexing wages and prices to inflation can provide a buffer against rising costs for both consumers and businesses.

- Utilizing inflation-hedging assets like real estate or commodities can offer a safeguard against the erosion of purchasing power.