Health savings accounts (HSAs) set the stage for this captivating journey, offering readers a peek into a narrative filled with details and originality right from the start.

As we delve deeper into the world of HSAs, we will uncover the ins and outs of this financial tool that can revolutionize the way we save for healthcare expenses.

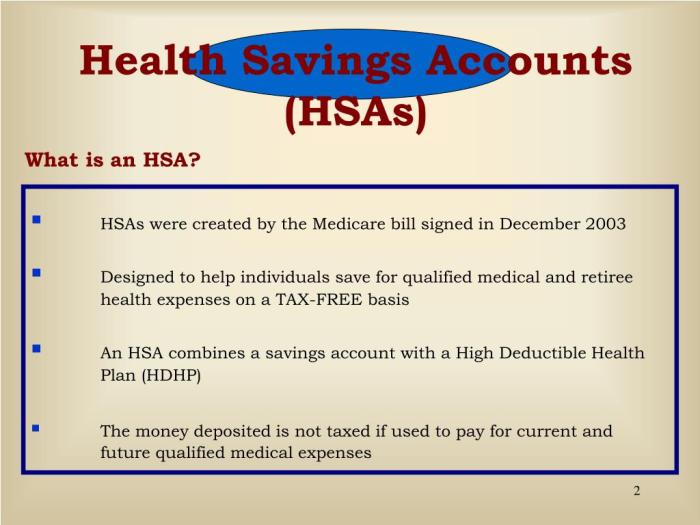

Overview of Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a tax-advantaged savings account that individuals can use to pay for qualified medical expenses. It is designed to help individuals with high-deductible health plans save money for medical expenses not covered by insurance.

HSAs offer several benefits, including tax advantages, flexibility in spending, and the ability to save for future healthcare costs. Anyone enrolled in a high-deductible health plan (HDHP) can open an HSA, regardless of their income level.

Purpose of HSAs and Who Can Benefit

- HSAs allow individuals to save money tax-free for medical expenses such as doctor visits, prescriptions, and other qualified expenses.

- Employers may also contribute to their employees’ HSAs, providing an additional benefit.

- HSAs can benefit individuals who anticipate high medical expenses or want to save for future healthcare costs.

Tax Advantages Associated with HSAs

- Contributions to an HSA are tax-deductible, reducing the individual’s taxable income.

- Interest and investment earnings on the HSA funds are tax-free as long as they are used for qualified medical expenses.

- Withdrawals for qualified medical expenses are also tax-free, making HSAs a valuable tool for saving on healthcare costs.

Eligibility and Contribution Limits

When it comes to opening a Health Savings Account (HSA), there are specific criteria that must be met in order to be eligible. Additionally, there are limits on how much an individual or family can contribute to an HSA each year.

Eligibility Criteria

To be eligible to open an HSA, you must be enrolled in a high-deductible health plan (HDHP). You cannot be covered by any other health insurance that is not an HDHP, you cannot be enrolled in Medicare, and you cannot be claimed as a dependent on someone else’s tax return.

Contribution Limits

For 2021, the contribution limit for individuals is $3,600 and for families, it is $7,200. If you are 55 or older, you are allowed to make an additional catch-up contribution of $1,000. It’s important to note that these limits can change annually, so it’s essential to stay up-to-date with any adjustments made by the IRS.

Qualifying Medical Expenses

When it comes to using your HSA funds for medical expenses, there are certain criteria to keep in mind. Let’s take a look at what qualifies as eligible expenses and what does not.

Common Qualifying Medical Expenses

- Prescription medications

- Doctor’s visits

- Dental care

- Vision care, including glasses and contact lenses

- Mental health services

- Physical therapy

- Medical equipment and supplies

Expenses Not Eligible for HSA Payments

- Cosmetic procedures

- Health club memberships

- Over-the-counter medications without a prescription

- Non-prescription supplements

Examples of Using HSA Funds for Medical Services

Let’s say you have a $500 medical bill from a recent doctor’s visit. You can use your HSA funds to cover this expense, ensuring you are not out of pocket for the full amount. Similarly, if you need to get a prescription filled for antibiotics, you can use your HSA funds to pay for the medication without any hassle.

Investment Options and Growth

Health Savings Accounts (HSAs) offer a unique opportunity for individuals to invest their funds for potential growth over time. By choosing the right investment options, account holders can maximize the growth of their HSA funds and achieve long-term financial goals.

Investment Options Available

- Stocks: Investing in individual stocks can provide high growth potential but also comes with higher risk.

- Mutual Funds: Mutual funds offer diversification and professional management, making them a popular choice for HSA investments.

- Bonds: Bonds are a lower-risk investment option that can provide steady income but may offer lower growth potential.

- ETFs: Exchange-traded funds combine the features of stocks and mutual funds, offering diversification and lower fees.

Growth Potential of HSA Investments

Over time, HSA funds invested in the right options can experience compound growth, allowing account holders to build a substantial nest egg for future healthcare expenses. The tax advantages of HSAs, such as tax-free growth and withdrawals for qualified medical expenses, further enhance the growth potential of these investments.

Comparison to Traditional Savings Accounts

- Unlike traditional savings accounts that offer minimal interest rates, HSA investments can potentially provide higher returns, allowing account holders to outpace inflation and grow their funds more effectively.

- While there are risks associated with investing in the market, the long-term growth potential of HSA investments often outweighs the conservative growth of traditional savings accounts.

Withdrawals and Distributions

When it comes to Health Savings Accounts (HSAs), understanding how to withdraw funds and the tax implications is crucial for maximizing the benefits of this financial tool.

Process of Withdrawing Funds

- To withdraw funds from an HSA, you can use your HSA debit card, write a check, or make an online transfer.

- Make sure to keep receipts for all qualified medical expenses to avoid penalties for non-qualified withdrawals.

Tax Implications of HSA Withdrawals

- Qualified HSA withdrawals used for eligible medical expenses are tax-free.

- If you withdraw funds for non-qualified expenses before age 65, you’ll face a 20% penalty in addition to regular income tax.

- After age 65, non-qualified withdrawals are subject to regular income tax but no penalty.

Examples of Qualified and Non-Qualified Distributions

- Qualified Distribution: Using HSA funds to pay for doctor visits, prescription medications, and dental care.

- Non-Qualified Distribution: Using HSA funds for cosmetic procedures, over-the-counter medications without a prescription, or health club memberships.

Benefits of HSAs

Health Savings Accounts (HSAs) offer a variety of benefits that can help individuals manage and save for their healthcare expenses. One of the key benefits is the ability to contribute pre-tax dollars to the account, which can lower your taxable income and save you money on taxes. Additionally, the funds in an HSA can be rolled over from year to year, allowing you to save for future medical needs and emergencies.

Tax Advantages

- Contributions are tax-deductible

- Earnings grow tax-free

- Withdrawals for qualified medical expenses are tax-free

Flexibility and Control

- Unused funds roll over from year to year

- Account is portable if you change jobs

- You can choose how to invest your HSA funds

Comparison to Other Healthcare Savings Options

- Unlike Flexible Spending Accounts (FSAs), HSA funds roll over and are not “use it or lose it”

- Compared to Health Reimbursement Arrangements (HRAs), HSAs are owned by the individual and can be used for future medical expenses even if you change jobs

- HSAs offer triple tax benefits that FSAs and HRAs do not provide