Step into the world of Annuities explained where the financial landscape unfolds in a captivating way. Get ready to dive deep into the intricacies of annuities and discover the key aspects that make them a vital component of financial planning.

In this guide, we will break down the concept of annuities, explore the different types available, and weigh the pros and cons to help you make informed decisions.

Annuities Overview

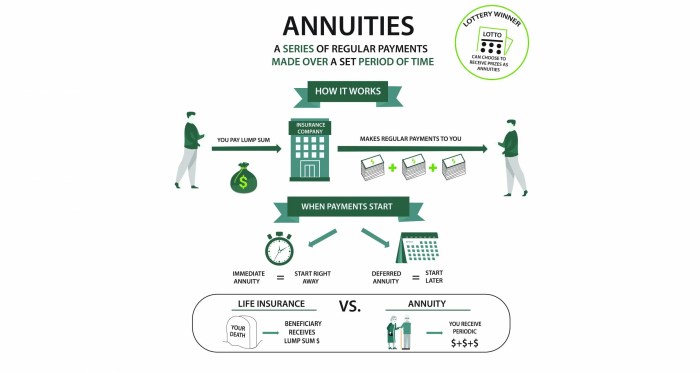

An annuity is a financial product that provides a series of payments made at equal intervals. It is typically used as a tool for retirement planning or to secure a steady income stream for a specific period.

Types of Annuities

Annuities can be categorized into several types based on how they are structured and when payments are made:

- Fixed Annuities: Offer a guaranteed payout over a specific period.

- Variable Annuities: Payments fluctuate based on the performance of underlying investments.

- Immediate Annuities: Payments begin shortly after the initial investment.

- Deferred Annuities: Payments start at a later date, allowing for accumulation of funds.

Purpose of Annuities in Financial Planning

Annuities play a crucial role in financial planning by providing a reliable source of income during retirement. They help individuals create a stream of payments to supplement other sources of income and ensure financial security in later years. Annuities can also offer tax-deferred growth and protection against market fluctuations, making them a valuable asset in a well-rounded financial plan.

How Annuities Work

Annuities function as financial products designed to provide a steady stream of income in retirement. When you purchase an annuity, you are essentially entering into a contract with an insurance company.

Process of Purchasing an Annuity

- Choose the type of annuity: Decide whether you want a fixed, variable, or indexed annuity based on your financial goals and risk tolerance.

- Select the payment structure: Determine whether you want to receive payments immediately (immediate annuity) or at a later date (deferred annuity).

- Decide on the payout options: Select how you want to receive payments – whether as a lump sum, periodic payments, or a combination of both.

- Consider any additional features: Some annuities offer riders that provide benefits such as long-term care coverage or death benefits.

- Submit the application and fund the annuity: Complete the necessary paperwork and transfer the funds to the insurance company to start the annuity contract.

Role of Insurance Companies in Offering Annuities

Insurance companies play a key role in offering annuities by pooling funds from multiple annuitants to create a diversified investment portfolio. They manage the investments and assume the risk of guaranteeing income payments to annuity holders. Insurance companies also provide customer service, process claims, and ensure regulatory compliance to protect the interests of annuity owners.

Types of Annuities

When it comes to annuities, there are various types to choose from based on your financial goals and risk tolerance. Let’s dive into the main types of annuities available in the market.

Fixed Annuities vs. Variable Annuities

Fixed annuities offer a guaranteed interest rate for a specific period, providing a stable and predictable income stream. On the other hand, variable annuities allow you to invest in sub-accounts similar to mutual funds, offering the potential for higher returns but also carrying more risk due to market fluctuations.

Indexed Annuities and Their Unique Features

Indexed annuities are tied to a stock market index, such as the S&P 500, offering the opportunity to earn returns based on the index performance while also providing downside protection. These annuities typically come with a cap on potential gains to balance risk and reward for investors.

Immediate Annuities versus Deferred Annuities

Immediate annuities start providing payouts shortly after a lump sum payment, offering a guaranteed income stream for a predetermined period. On the other hand, deferred annuities allow you to accumulate funds over time before starting withdrawals, giving you the flexibility to plan for future expenses like retirement or healthcare costs.

Pros and Cons of Annuities

When considering investing in annuities, it’s essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Annuities

- Guaranteed Income: Annuities offer a steady stream of income, providing financial security during retirement.

- Tax-Deferred Growth: Earnings from annuities grow tax-deferred, allowing your investment to compound over time.

- Flexible Payout Options: You can choose how you receive your payments, whether as a lump sum, periodic payments, or a combination of both.

- Death Benefit: Annuities often come with a death benefit, ensuring that your beneficiaries receive a payout if you pass away before receiving the full amount.

Drawbacks of Annuities

- High Fees: Annuities can come with high fees and charges, which may eat into your returns over time.

- Lack of Liquidity: Some annuities have strict withdrawal rules and penalties for early withdrawals, limiting your access to your funds.

- Complexity: Understanding the terms and conditions of annuities can be challenging, leading to confusion for some investors.

- Interest Rate Risk: Fixed annuities are susceptible to interest rate fluctuations, affecting the returns on your investment.

Suitability of Annuities

- For Retirement Income: Annuities can be suitable for individuals looking to secure a reliable source of income during retirement.

- Long-Term Investors: Those who are willing to commit their funds for the long term may benefit from the growth potential of annuities.

- Risk-Averse Individuals: Annuities can be a suitable option for investors seeking a conservative approach to wealth preservation.

- Not Suitable for Short-Term Goals: If you have short-term financial needs or require liquidity, annuities may not be the best investment choice.