Get ready to dive into the realm of financial investments, where the game is strong and the stakes are high. This is where money talks and savvy investors walk the walk. So buckle up and let’s explore the different types of financial investments that can make or break your bankroll.

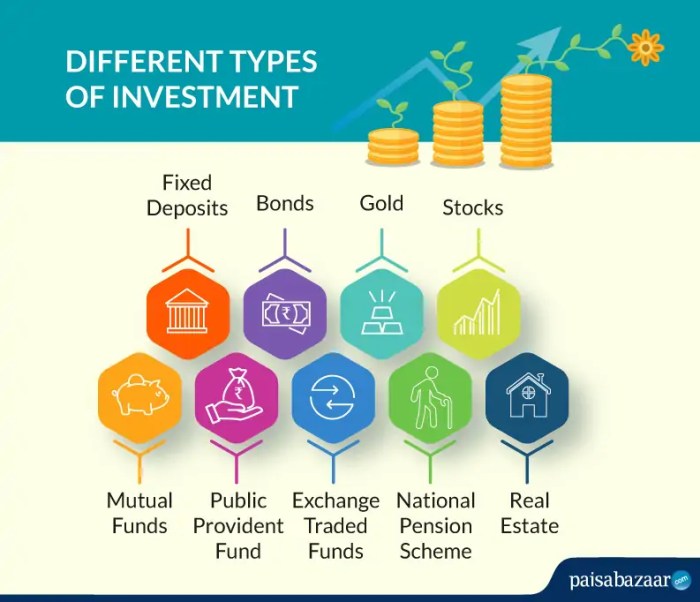

From stocks to real estate, bonds to mutual funds, we’ll break down the essentials and give you the inside scoop on how to navigate the financial jungle like a boss.

Types of Financial Investments

Financial investments are assets that individuals or organizations acquire with the expectation of generating income or profit. They are crucial for building wealth, achieving financial goals, and securing future financial stability.

Traditional Investments

Traditional investments are well-known and widely used options in the financial market. They include:

- Stocks: Ownership in a company, representing a share of ownership and potential profits through dividends and capital appreciation.

- Bonds: Debt securities issued by governments or corporations, offering fixed interest payments over a specified period.

Alternative Investments

Alternative investments offer diversification and unique opportunities compared to traditional investments. They include:

- Real Estate: Investing in properties or real estate funds for rental income and potential appreciation.

- Commodities: Investing in physical goods like gold, silver, or oil, often used as a hedge against inflation or economic uncertainty.

Risk and Return Characteristics

Each type of financial investment carries its own risk and return profile:

| Investment Type | Risk | Return |

|---|---|---|

| Stocks | High | High potential returns |

| Bonds | Low to Moderate | Fixed interest payments |

| Real Estate | Moderate | Rental income and appreciation |

| Commodities | High | Varies based on market conditions |

Stocks

Stocks represent ownership in a company. When you buy a stock, you essentially own a small portion of that company. Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) or the Nasdaq.

Types of Stocks

- Common Stocks: These are the most common type of stocks that represent ownership in a company and provide voting rights in shareholder meetings. Common stockholders are entitled to dividends if the company distributes profits.

- Preferred Stocks: Preferred stocks are a type of stock that has a higher claim on assets and earnings than common stocks. They often do not have voting rights but have a fixed dividend payment.

Well-Known Stocks

- Apple Inc. (AAPL): Apple is a technology company known for its iPhones, iPads, and Mac computers. It has shown consistent growth over the years and is one of the most valuable companies in the world.

- Amazon.com Inc. (AMZN): Amazon is an e-commerce giant that has diversified into various industries, including cloud computing and streaming services. Its stock has performed exceptionally well in recent years.

Factors Influencing Stock Prices

- Company Performance: The financial health and performance of a company can significantly impact its stock price.

- Market Conditions: Overall market trends, economic conditions, and investor sentiment can influence stock prices.

- Regulatory Environment: Changes in regulations or government policies can affect certain industries and, consequently, stock prices.

Bonds

Bonds are a type of financial investment where investors lend money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. They are considered fixed-income securities and play a crucial role in diversifying an investment portfolio.

Types of Bonds

- Government Bonds: Issued by governments to fund public projects or activities. They are considered low-risk investments as they are backed by the government’s ability to tax its citizens.

- Corporate Bonds: Issued by corporations to raise capital for various purposes. They offer higher returns compared to government bonds but come with higher risk.

- Municipal Bonds: Issued by state and local governments to finance public projects. They are exempt from federal taxes and sometimes state taxes, making them attractive to investors in higher tax brackets.

Risks Associated with Investing in Bonds

- Interest Rate Risk: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall.

- Default Risk: The risk that the issuer may be unable to make interest payments or repay the principal amount.

- Inflation Risk: The risk that inflation will erode the purchasing power of the bond’s future cash flows.

Comparison of Bond Returns

- Bonds typically offer lower returns compared to stocks but are considered safer investments.

- Government bonds usually provide lower returns than corporate bonds due to their lower risk profile.

- Municipal bonds may offer tax advantages, making them more attractive to certain investors despite potentially lower returns.

Real Estate

Real estate is a popular investment option that involves purchasing, owning, managing, renting, or selling properties with the goal of generating profit. Investing in real estate can provide several benefits such as potential appreciation in property value, rental income, tax advantages, and portfolio diversification.

Ways to Invest in Real Estate

- Direct Ownership: Buying physical properties like residential homes, commercial buildings, or land for investment purposes.

- REITs (Real Estate Investment Trusts): Investing in companies that own and manage real estate properties, offering investors the opportunity to earn dividends and benefit from property value appreciation.

- Crowdfunding: Pooling money with other investors to invest in real estate projects, typically done through online platforms.

Factors to Consider when Investing in Real Estate

- Location: The location of the property can greatly impact its value, rental income potential, and demand.

- Market Trends: Understanding the real estate market trends, supply and demand dynamics, and economic conditions can help make informed investment decisions.

- Risk Tolerance: Consider your risk tolerance and investment goals when choosing the type of real estate investment.

Examples of Successful Real Estate Investments

- Investing in rental properties in high-demand areas with steady rental income and potential for property value appreciation.

- Purchasing commercial properties in prime locations with long-term lease agreements from reputable tenants.

- Investing in REITs that have a track record of consistent dividends and portfolio growth.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Types of Mutual Funds

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They have lower fees compared to actively managed funds.

- Actively Managed Funds: These funds are managed by professionals who actively buy and sell securities in an attempt to outperform the market. They generally have higher fees.

Benefits of Investing in Mutual Funds

- Mutual funds offer instant diversification by investing in a variety of securities.

- They are managed by professionals, saving investors the time and effort needed for individual stock selection.

- Investors can start with a relatively small amount of money and still benefit from a diversified portfolio.

Comparison with Other Investment Vehicles

- Mutual funds provide built-in diversification, reducing overall risk compared to investing in individual stocks or bonds.

- Compared to real estate, mutual funds offer more liquidity as investors can easily buy and sell fund shares.

- When compared to stocks, mutual funds spread risk across multiple securities, reducing the impact of a single stock’s poor performance on the overall portfolio.