Step into the world of Financial wellness programs where employees’ well-being takes center stage. Get ready for a deep dive into the importance, components, implementation, and success metrics of these programs in an engaging american high school hip style.

Let’s explore how Financial wellness programs can impact employee productivity, mental health, and overall work performance.

Importance of Financial Wellness Programs

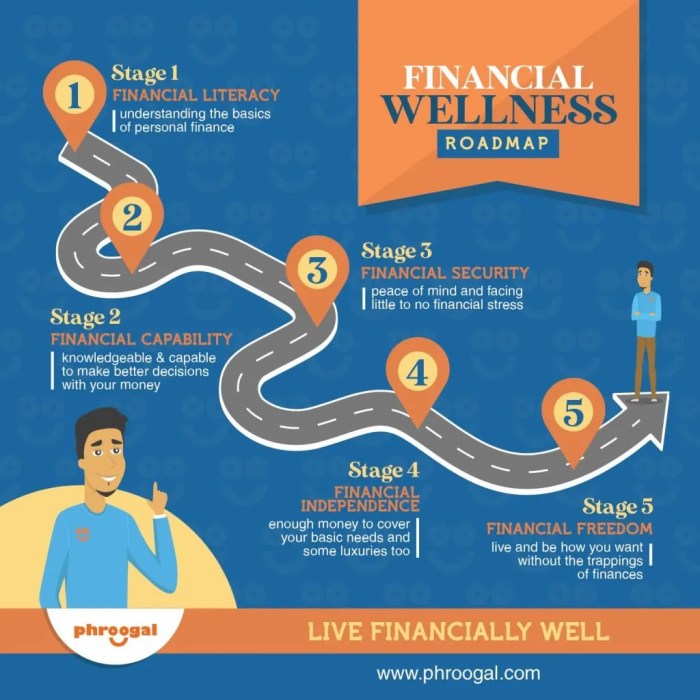

Financial wellness programs are crucial for employees’ well-being as they provide the necessary resources and support to help individuals manage their finances effectively. These programs offer education on budgeting, saving, investing, and managing debt, which are essential skills for financial stability.

Improving Employee Productivity

Financial wellness programs can improve employee productivity by reducing financial stress and increasing overall well-being. When employees are worried about money problems, it can significantly impact their focus, motivation, and performance at work. By providing access to financial education and resources, employers can help alleviate financial stress and create a more productive work environment.

- Employees who feel more financially secure are less likely to be distracted by money worries during work hours, leading to increased productivity and efficiency.

- Financially healthy employees are more likely to take advantage of retirement savings options and other benefits offered by their employer, leading to better long-term financial planning and security.

- Reducing financial stress can also improve employee morale, engagement, and job satisfaction, ultimately contributing to a positive work culture and higher retention rates.

Impact on Mental Health and Work Performance

Financial stress can have a significant impact on employees’ mental health and work performance. When individuals are struggling financially, they may experience increased anxiety, depression, and overall decreased well-being, all of which can affect their ability to focus, make decisions, and perform at their best in the workplace.

- Employees dealing with financial stress may be more likely to take time off work due to health issues related to stress, leading to higher absenteeism rates and lower productivity.

- Financially stressed employees may also be more prone to making mistakes at work, missing deadlines, and having difficulty concentrating, all of which can impact their job performance and overall success.

- By offering financial wellness programs, employers can support their employees in managing their finances effectively, reducing financial stress, and ultimately improving their mental health and work performance.

Components of Effective Financial Wellness Programs

Financial wellness programs encompass various components that contribute to their success. These components play a crucial role in helping individuals manage their finances effectively, plan for the future, and achieve financial stability.

Role of Budgeting and Saving

Budgeting and saving are fundamental aspects of financial wellness programs. Budgeting helps individuals track their expenses, prioritize their spending, and ensure they are living within their means. Saving, on the other hand, allows individuals to build an emergency fund, save for future goals, and secure their financial future. Together, budgeting and saving form the foundation of a healthy financial plan.

Importance of Financial Education and Resources

Financial education plays a vital role in empowering individuals to make informed financial decisions. By providing access to resources such as workshops, seminars, online tools, and personalized guidance, financial wellness programs equip individuals with the knowledge and skills needed to navigate complex financial situations. These resources help individuals understand key financial concepts, develop good money habits, and build confidence in managing their finances effectively.

Implementation of Financial Wellness Programs

Implementing financial wellness programs in organizations is crucial for promoting the financial health and well-being of employees. By providing resources, education, and support, companies can help their employees better manage their finances and reduce stress related to money matters.

Strategies for Implementing Financial Wellness Programs

- Collaborate with financial experts to design and implement tailored programs.

- Offer workshops, seminars, and one-on-one consultations to educate employees on financial literacy.

- Integrate financial wellness into overall wellness initiatives to emphasize its importance.

- Utilize digital tools and platforms to make resources easily accessible to employees.

Tailoring Financial Wellness Programs to Meet Diverse Employee Needs

- Conduct surveys or assessments to understand the specific financial challenges and goals of employees.

- Provide a range of resources and tools that cater to different financial situations, such as budgeting, saving, investing, and debt management.

- Offer flexibility in program delivery to accommodate varying learning styles and preferences.

Successful Case Studies of Financial Wellness Programs

- Company X implemented a financial wellness program that resulted in a 20% decrease in employee stress related to finances.

- Organization Y saw an increase in employee productivity and job satisfaction after introducing personalized financial coaching sessions.

- Company Z reported higher employee retention rates and improved overall morale following the launch of a comprehensive financial wellness program.

Measuring the Success of Financial Wellness Programs

Financial wellness programs are becoming increasingly popular in organizations, but it is essential to measure their success to ensure they are effective in improving employees’ financial well-being. By tracking key performance indicators (KPIs) and gathering feedback from employees, organizations can evaluate the impact of these programs and make necessary adjustments for better results.

Effectiveness Measurement

- Employee Engagement: Monitoring the participation rates and level of engagement in financial wellness activities can indicate how well the program is being received by employees.

- Financial Behavior Changes: Tracking changes in savings rates, debt levels, and overall financial habits can show the effectiveness of the program in influencing positive financial behaviors.

- Employee Satisfaction: Conducting surveys or feedback sessions to gauge employee satisfaction with the financial wellness program can provide valuable insights into its success.

Key Performance Indicators (KPIs)

- Financial Stress Levels: Measuring the decrease in financial stress levels among employees can be a key indicator of the program’s success.

- Retirement Readiness: Assessing employees’ preparedness for retirement through savings contributions and retirement planning participation can indicate the impact of the program.

- Utilization Rates: Monitoring the utilization rates of financial wellness resources and tools provided can help determine the program’s effectiveness.

Employee Feedback Collection

- Surveys: Conducting regular surveys to gather feedback on the financial wellness program can help organizations understand what is working well and what needs improvement.

- Focus Groups: Hosting focus group sessions with employees to delve deeper into their experiences with the program can provide qualitative insights for program evaluation.

- One-on-One Meetings: Offering one-on-one meetings with employees to discuss their financial goals and challenges can help tailor the program to better meet their needs.