Diving into the realm of Understanding bonds opens up a world of financial intrigue and opportunity. From the basics of what bonds are to the intricate dance they perform with interest rates, this topic is sure to captivate your interest and expand your financial knowledge.

As we delve deeper into the nuances of bond valuation and explore the benefits they offer, you’ll gain a comprehensive understanding of this essential aspect of the financial market.

What are Bonds?

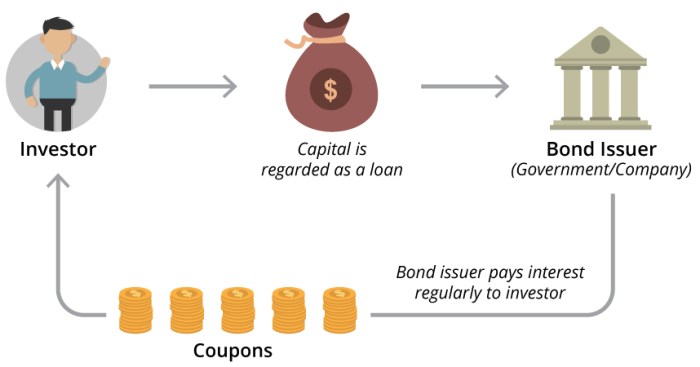

Bonds are essentially debt securities issued by governments or corporations to raise capital. When an investor buys a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

The relationship between bonds and interest rates is crucial. When interest rates rise, bond prices tend to fall, and vice versa. This is because newly issued bonds will offer higher interest rates to attract investors, making existing bonds with lower rates less appealing in comparison.

Types of Bonds

- Government Bonds: Issued by governments to finance public projects or cover budget deficits. Examples include Treasury bonds and municipal bonds.

- Corporate Bonds: Issued by companies to raise capital for various purposes, such as expansion or debt refinancing.

- Mortgage-Backed Securities (MBS): These bonds are backed by a pool of mortgages, providing investors with exposure to the real estate market.

- Junk Bonds: High-risk bonds issued by companies with lower credit ratings, offering higher yields to compensate for the increased risk.

How Bonds Work

When it comes to understanding how bonds work, it’s essential to grasp the process of how they are issued and traded in the financial market. Bonds are essentially debt securities issued by governments, municipalities, or corporations to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Bond Issuance and Trading

Bonds are typically issued through an initial offering where the issuer specifies the interest rate, maturity date, and face value of the bond. Once issued, bonds can be traded on the secondary market, where investors can buy and sell them based on prevailing market conditions. The prices of bonds in the secondary market are influenced by various factors such as interest rates, credit ratings, and economic conditions.

Bond Maturity and Significance

The concept of bond maturity refers to the date when the issuer is required to repay the principal amount to bondholders. Bonds can have varying maturity periods ranging from short-term (less than 1 year) to long-term (10 years or more). The maturity date is crucial as it determines the duration of the investment and when investors will receive the principal amount back.

Risks Associated with Investing in Bonds

- Bond Default Risk: This is the risk that the issuer may fail to make interest or principal payments as promised.

- Interest Rate Risk: Bonds are sensitive to changes in interest rates, with prices typically falling when rates rise and vice versa.

- Inflation Risk: Inflation can erode the purchasing power of bond returns over time, especially for fixed-rate bonds.

- Market Risk: Fluctuations in the bond market can impact the value of bonds held by investors.

Bond Valuation

When it comes to bond valuation, there are several key factors that influence the value of a bond. These include the bond’s coupon rate, maturity date, credit rating, and prevailing market interest rates. Understanding how these elements interact is crucial in determining the price of a bond.

Factors Influencing Bond Value

- The bond’s coupon rate: A higher coupon rate typically means a higher bond value, as it offers more interest income to the bondholder.

- Maturity date: Bonds with longer maturity dates are generally more sensitive to changes in interest rates, impacting their value.

- Credit rating: Bonds issued by companies with higher credit ratings tend to have higher values due to lower default risk.

- Market interest rates: Changes in market interest rates have an inverse relationship with bond prices. When interest rates rise, bond prices fall, and vice versa.

Calculating Bond Prices

- Present Value: One common method to calculate bond prices is to determine the present value of the bond’s future cash flows, which includes coupon payments and the principal repayment at maturity.

- Yield to Maturity (YTM): Another method is to calculate the bond’s YTM, which represents the total return an investor can expect if they hold the bond until maturity. This is based on the bond’s current price, coupon payments, and time to maturity.

Impact of Interest Rate Changes

- When interest rates rise, newly issued bonds come with higher coupon rates, making existing bonds with lower rates less attractive. As a result, their prices decrease to align with the market.

- Conversely, when interest rates fall, existing bonds with higher coupon rates become more valuable, leading to an increase in their prices.

Benefits of Bonds

Investing in bonds can offer several advantages for investors. One key benefit is the ability to earn a steady income stream through regular interest payments. This can be particularly attractive for individuals seeking stable returns on their investments.

Steady Income Stream

Bonds provide investors with a predictable and consistent source of income through interest payments. These payments are usually made semi-annually or annually, providing investors with a reliable cash flow that can help meet financial goals or cover expenses.

Diversified Investment Portfolio

Including bonds in a diversified investment portfolio can help reduce overall risk. Bonds tend to have lower volatility compared to stocks, which can help balance out the fluctuations in a portfolio. By spreading investments across different asset classes, investors can potentially minimize the impact of market downturns on their overall wealth.