Yo, peeps! Ready to dive into the world of mutual funds? This ain’t your typical finance class, we’re about to break down what mutual funds are all about in a way that’s easy to grasp and totally rad.

So buckle up and get ready to level up your investment game with this guide on Understanding mutual funds.

What are Mutual Funds?

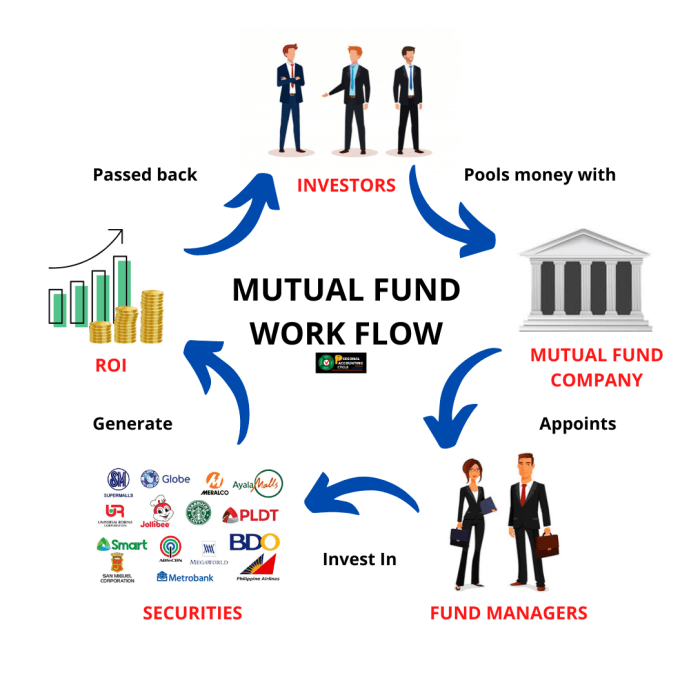

When it comes to mutual funds, think of them as a pool of money collected from multiple investors to invest in various assets like stocks, bonds, or other securities. These funds are managed by professionals who make decisions on behalf of the investors to achieve specific investment objectives.

Types of Mutual Funds

- Equity Funds: These funds primarily invest in stocks, offering the potential for high returns but also higher risk.

- Bond Funds: These funds invest in bonds issued by governments or corporations, providing a fixed income but with lower risk compared to stocks.

- Money Market Funds: These funds invest in short-term, low-risk securities like Treasury bills, offering stability and liquidity.

- Index Funds: These funds aim to replicate the performance of a specific market index, providing diversification at a lower cost.

- Hybrid Funds: Also known as balanced funds, these invest in a mix of stocks and bonds to offer a balanced approach to risk and return.

Benefits of Investing in Mutual Funds

Investing in mutual funds comes with a variety of benefits that make it an attractive option for many investors. One of the main advantages is the opportunity for diversification without needing a large amount of capital. Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, which helps reduce risk.

Higher Returns

Mutual funds provide the potential for higher returns compared to traditional savings accounts or bonds.

- By investing in a wide range of securities, mutual funds can capture the growth potential of different industries and markets.

- Professional fund managers make investment decisions based on research and analysis, which can lead to better returns over time.

Professional Management

Expert fund managers handle the day-to-day investment decisions, saving investors time and effort.

- These professionals have the knowledge and experience to make informed decisions and adjust the portfolio as needed.

- Investors benefit from the expertise of seasoned professionals without having to actively manage their investments.

Liquidity and Convenience

Mutual funds offer liquidity, allowing investors to buy or sell shares at any time.

- Unlike some other investments, mutual funds provide easy access to funds when needed.

- Investors can easily buy or sell mutual fund shares through brokerage accounts or directly from the fund company.

Risks Associated with Mutual Funds

Investing in mutual funds comes with its own set of risks that investors need to be aware of. These risks can impact the performance of the mutual fund and the returns that investors may receive. It is important to understand these risks before making any investment decisions.

Market Fluctuations and Mutual Fund Investments

Market fluctuations play a significant role in determining the value of mutual fund investments. Fluctuations in the stock market, interest rates, inflation, and other economic factors can directly impact the performance of mutual funds. For example, during a bear market, when stock prices are falling, the value of equity mutual funds may decrease as well. On the other hand, during a bull market, when stock prices are rising, equity mutual funds may see an increase in value. It is essential for investors to be prepared for these fluctuations and understand how they can affect their investments.

Risk Management Strategies for Mutual Fund Investors

To mitigate the risks associated with mutual fund investments, investors can implement various risk management strategies. Diversification is a key strategy that involves spreading investments across different asset classes, sectors, and regions to reduce exposure to any single risk. Another strategy is to regularly review and rebalance the investment portfolio to ensure it aligns with the investor’s financial goals and risk tolerance. Additionally, investors can consider investing in mutual funds with lower expense ratios and fees to maximize their returns.

How to Choose the Right Mutual Fund

When it comes to choosing the right mutual fund, there are several factors to consider to ensure that your investment aligns with your financial goals and risk tolerance. Research and evaluation are key to making an informed decision.

Factors to Consider when Selecting a Mutual Fund

- Expense Ratio: Look for funds with low expense ratios as they can eat into your returns over time.

- Performance History: Analyze the fund’s past performance to get an idea of how it may perform in the future.

- Investment Objectives: Ensure that the fund’s investment objectives align with your own financial goals.

- Risk Tolerance: Consider your risk tolerance level and choose funds that match your comfort level with volatility.

Importance of Aligning Investment Goals with Mutual Funds

- Matching Risk Levels: Selecting funds that align with your risk tolerance can help you avoid unnecessary stress during market fluctuations.

- Meeting Financial Goals: By choosing funds that match your investment objectives, you increase the likelihood of reaching your financial goals.

- Long-Term Planning: Aligning your goals with mutual funds can help you create a well-balanced and diversified investment portfolio.

Tips on Researching and Evaluating Mutual Fund Options

- Read the Fund Prospectus: Understand the fund’s objectives, fees, and investment strategies by reading the prospectus.

- Check Ratings: Look at ratings from reputable sources to gauge the fund’s performance and risk level.

- Compare Similar Funds: Compare funds within the same category to identify the best option based on performance and expenses.

- Consult with Financial Advisors: Seek advice from financial experts to get a better understanding of the fund’s suitability for your portfolio.

Understanding Mutual Fund Fees

When investing in mutual funds, it’s essential to be aware of the various fees associated with them. These fees can significantly impact the overall returns on your investments. Let’s dive into the details:

Types of Fees Associated with Mutual Funds

- Expense Ratio: This fee covers the operating expenses of the mutual fund, including management fees, administrative costs, and other miscellaneous expenses. It is expressed as a percentage of the fund’s average net assets.

- Load Fees: These are sales charges that investors may have to pay when buying or selling mutual fund shares. Front-end loads are charged at the time of purchase, while back-end loads are charged when selling shares.

- Transaction Fees: Some mutual funds charge fees for buying or selling shares, known as transaction fees. These fees can vary depending on the type of transaction and the fund.

Impact of Fees on Mutual Fund Returns

- High fees can eat into your investment returns over time, reducing the overall profitability of your portfolio.

- Even seemingly small differences in fees can add up significantly over the long term, affecting the growth of your investments.

- It’s crucial to consider fees when choosing a mutual fund to ensure that you are maximizing your potential returns.

Minimizing Fees When Investing in Mutual Funds

- Look for low-cost mutual funds with competitive expense ratios to minimize the impact of fees on your returns.

- Consider investing in no-load mutual funds that do not charge sales commissions, allowing you to invest more of your money directly into the fund.

- Regularly review and compare the fees of different mutual funds to make informed investment decisions and optimize your portfolio’s performance.