What’s the deal with Financial regulations in the U.S.? Let’s dive into the world of rules and oversight, breaking it down in a way that’s easy to grasp.

From the history to the key players, we’ve got you covered with all you need to know about financial regulations in the U.S.

Overview of Financial Regulations in the U.S.

Financial regulations in the United States are designed to maintain stability, protect investors, and ensure the integrity of the financial system.

Purpose of Financial Regulations

The primary purpose of financial regulations is to safeguard the interests of investors, maintain market integrity, and prevent financial crises.

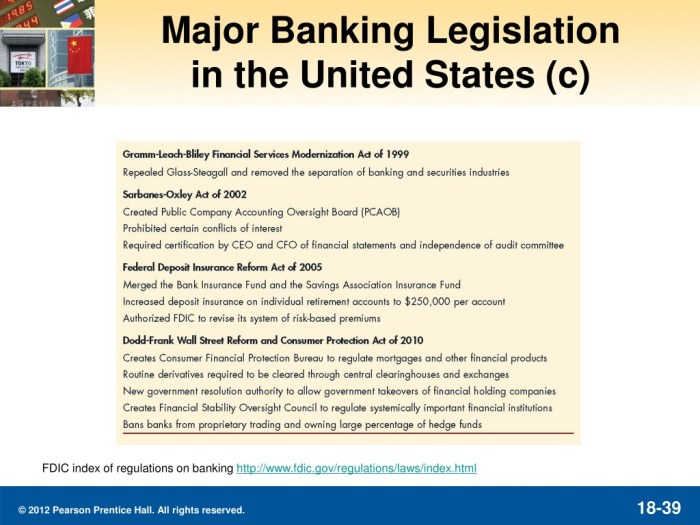

Brief History of Financial Regulations

Financial regulations in the U.S. have evolved over time in response to various financial crises, such as the Great Depression of the 1930s and the 2008 financial crisis.

Key Regulatory Bodies

Key regulatory bodies responsible for overseeing financial regulations in the U.S. include:

- Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- Financial Industry Regulatory Authority (FINRA)

- Federal Reserve System (Fed)

Types of Financial Regulations

Financial regulations in the U.S. cover a wide range of areas to ensure stability and protect consumers. Let’s dive into the different types of financial regulations and their impact on various sectors like banking, investment, and insurance.

Banking Regulations

Banking regulations in the U.S. are primarily aimed at safeguarding depositors’ funds and maintaining the stability of the financial system. The Federal Reserve, FDIC, and OCC are key regulatory bodies overseeing banks to prevent risks and ensure compliance with laws.

Investment Regulations

Investment regulations focus on the securities market to protect investors and maintain fair and transparent trading practices. The SEC plays a crucial role in enforcing rules related to securities offerings, market manipulation, and insider trading.

Insurance Regulations

Insurance regulations aim to protect policyholders by ensuring the solvency of insurance companies and fair treatment of customers. State insurance departments regulate the insurance industry, setting standards for products, pricing, and claims handling.

Comparing Regulatory Frameworks

Different financial products like stocks, bonds, and derivatives are subject to specific regulatory frameworks tailored to their unique risks and characteristics. While banking regulations focus on capital requirements and liquidity, investment regulations emphasize disclosure and investor protection.

The Role of Government Agencies

Government agencies play a crucial role in enforcing financial regulations in the United States. Let’s dive into the roles and responsibilities of agencies like the SEC, FDIC, and CFPB, and how they collaborate to ensure compliance with financial laws.

Securities and Exchange Commission (SEC)

The SEC is responsible for regulating the securities industry and protecting investors. It enforces laws governing the trading of stocks, bonds, and other securities. The SEC also oversees financial disclosures by publicly traded companies to ensure transparency and prevent fraud.

- The SEC investigates and prosecutes cases of insider trading, accounting fraud, and market manipulation.

- It sets regulations for securities exchanges, brokers, and investment advisers to promote fair and orderly markets.

- One significant case where the SEC intervened was the enforcement action against Bernie Madoff for running a Ponzi scheme, defrauding investors of billions of dollars.

Federal Deposit Insurance Corporation (FDIC)

The FDIC insures deposits in banks and thrift institutions, protecting depositors against bank failures. It also supervises and regulates financial institutions to ensure their soundness and stability.

- The FDIC monitors the health of banks and takes action to prevent or mitigate risks that could lead to bank failures.

- It investigates and resolves failed banks, ensuring that depositors receive their insured funds promptly.

- During the 2008 financial crisis, the FDIC played a key role in stabilizing the banking system and restoring confidence in the financial markets.

Consumer Financial Protection Bureau (CFPB)

The CFPB is tasked with protecting consumers in the financial marketplace by enforcing laws related to consumer financial products and services. It provides oversight on financial institutions to ensure they treat consumers fairly.

- The CFPB investigates consumer complaints and takes enforcement actions against companies engaged in unfair, deceptive, or abusive practices.

- It educates consumers about their rights and responsibilities when dealing with financial products and services.

- An example of the CFPB’s intervention is the enforcement action against Wells Fargo for opening unauthorized accounts in customers’ names.

Compliance and Enforcement

The compliance and enforcement of financial regulations are crucial in maintaining the stability and integrity of the financial system. Financial institutions often face challenges in ensuring they meet all regulatory requirements, which can be complex and constantly changing.

Challenges Faced by Financial Institutions

- Keeping up with changing regulations: Financial institutions must stay updated with the latest regulatory changes to ensure compliance.

- Resource constraints: Compliance often requires significant resources in terms of time, money, and expertise.

- Data management: Managing and organizing vast amounts of data to meet reporting requirements can be a challenge.

Penalties for Non-Compliance

- Financial penalties: Non-compliance can result in fines imposed by regulatory agencies.

- Reputation damage: Violations of financial regulations can harm the reputation of the institution, leading to loss of trust from clients and investors.

- Licensing issues: Non-compliance may result in the suspension or revocation of licenses, preventing the institution from operating.

Best Practices for Ensuring Adherence

- Establish a compliance culture: Instill a culture of compliance throughout the organization, from top management to frontline staff.

- Regular training and education: Provide ongoing training to employees to ensure they are aware of the latest regulatory requirements.

- Implement robust monitoring systems: Utilize technology to monitor and track compliance efforts effectively.