Yo, check it out – we’re diving into the world of financial literacy for kids, where money moves and knowledge grooves. From setting the stage for a solid financial future to breaking down money matters in a cool way, this topic is all about helping kids level up their financial game. So grab a seat and let’s vibe with some money wisdom for the young ones.

Now, let’s break it down with some key points about the importance of financial literacy, basic concepts to teach kids, methods for teaching, and fun activities to enhance those money smarts.

Importance of Financial Literacy for Kids

Teaching financial literacy to kids is crucial as it equips them with the necessary skills and knowledge to make informed financial decisions throughout their lives. By instilling these concepts early on, children can develop a strong foundation for managing money responsibly and planning for their future.

Long-term Benefits

- Children who are financially literate are more likely to save money and avoid debt as they grow older.

- Understanding the value of money and budgeting early on can lead to better financial habits in adulthood.

- Financially literate kids are more prepared to handle unexpected expenses and emergencies.

Impact on Future Financial Decisions

Early financial education can shape children’s attitudes towards money and influence their spending and saving habits in the future.

By teaching kids about concepts like budgeting, saving, investing, and the importance of setting financial goals, parents and educators can help them make smarter financial decisions as adults.

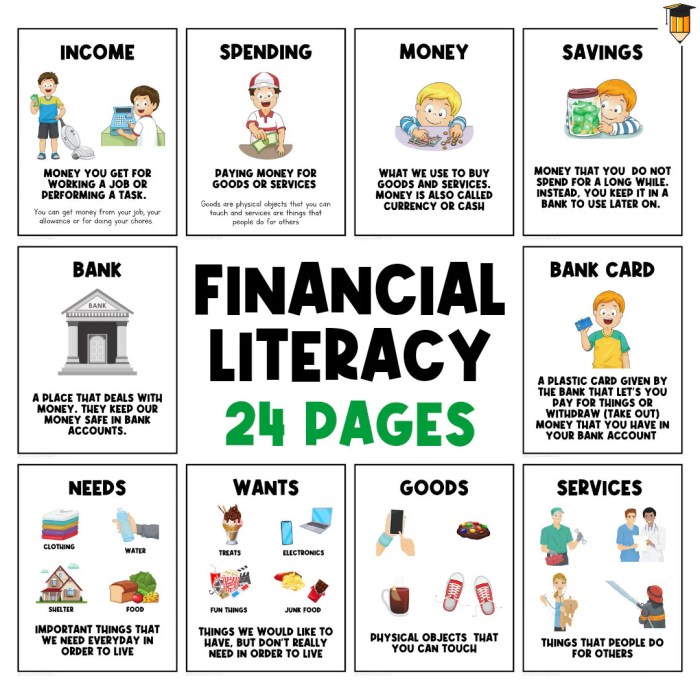

Basic Concepts to Teach Kids

Teaching kids about financial concepts from a young age sets a strong foundation for their future financial well-being. Here are some fundamental concepts to introduce to children in a simplified and engaging manner:

Budgeting

Teaching kids about budgeting involves explaining the concept of setting limits on spending and prioritizing needs over wants. One creative way to introduce budgeting is by giving children a set allowance and encouraging them to allocate it for different purposes like saving, spending, and giving.

Saving

Introduce the concept of saving money by explaining how setting aside a portion of their allowance or earnings can help them achieve their financial goals in the future. Encourage kids to save for a specific item they want, like a toy or a game, to make the concept more tangible.

Investing

While the idea of investing may seem complex, simplify it by teaching kids that investing means putting money into something with the hope of getting more money back in the future. You can use examples like investing in a piggy bank that grows their savings over time or planting seeds in a garden that will yield fruits later on.

Methods and Resources for Teaching Financial Literacy

Financial literacy for kids can be effectively taught through hands-on activities, interactive games, and real-life examples. By making learning about money fun and engaging, children are more likely to retain important concepts and apply them in their daily lives.

Effective Methods for Teaching Financial Literacy

- Role-playing games where kids act out scenarios like running a lemonade stand or budgeting for a family vacation.

- Using technology such as educational apps and online simulations to help kids understand concepts like budgeting, saving, and investing.

- Incorporating financial lessons into everyday activities, like grocery shopping or comparing prices at stores.

Age-Appropriate Resources and Tools

- Books and storybooks that teach money management skills in a fun and engaging way.

- Online resources such as videos, websites, and interactive tools designed specifically for kids to learn about finances.

- Financial literacy workbooks and worksheets tailored to different age groups to practice budgeting, saving, and spending wisely.

Role of Parents, Schools, and Other Institutions

- Parents can lead by example by involving kids in household budgeting discussions and teaching them about responsible money habits.

- Schools can integrate financial literacy into their curriculum and offer workshops or guest speakers to educate students on money management.

- Financial institutions and community organizations can provide resources and workshops to help kids develop a strong foundation in financial literacy.

Practical Activities and Games to Enhance Financial Literacy

Teaching kids about money management doesn’t have to be boring! Engaging them in fun activities and games can make learning about financial literacy enjoyable and effective. Hands-on experiences can greatly enhance their understanding of important financial concepts and skills.

1. Money Management Board Games

Board games like Monopoly, The Game of Life, or Payday can be excellent tools for teaching kids about budgeting, saving, investing, and making financial decisions. These games simulate real-life financial scenarios and help children learn valuable money management skills in a fun and interactive way.

2. Role-Playing Activities

Encourage kids to play pretend stores or restaurants where they are the cashiers, customers, or owners. This hands-on activity can teach them about making purchases, handling money, calculating change, and budgeting. It also helps them understand the value of money and the importance of responsible spending.

3. Savings Challenges

Set up a savings challenge for kids where they have a goal to save a certain amount of money within a specified period. This can be done by creating a savings jar or using a piggy bank. Encourage them to save a portion of their allowance or earnings regularly and track their progress towards their savings goal. This activity instills the habit of saving and goal-setting in children.

4. Grocery Shopping Game

Take kids grocery shopping with a set budget and a list of items to purchase. Have them compare prices, make decisions based on their budget, and calculate the total cost of their items. This activity teaches children about making smart purchasing choices, understanding the value of money, and sticking to a budget.

5. Online Financial Literacy Games

There are various online games and apps designed to teach kids about financial concepts such as budgeting, saving, investing, and managing money. These interactive games make learning about finance engaging and entertaining for children while improving their financial literacy skills.