Diving into the world of financial planning, this intro sets the stage for an exciting journey into why financial planning is a game-changer for individuals. From setting financial goals to budgeting and saving, we’ll explore it all in a way that’s fresh and engaging.

Get ready to uncover the secrets to financial success and stability in a language that speaks to you.

Importance of Financial Planning

Financial planning is crucial for individuals as it helps them manage their money effectively, achieve their financial goals, and secure their future. Without a solid financial plan in place, individuals may struggle to make ends meet, face unexpected financial hardships, and miss out on opportunities for growth and prosperity.

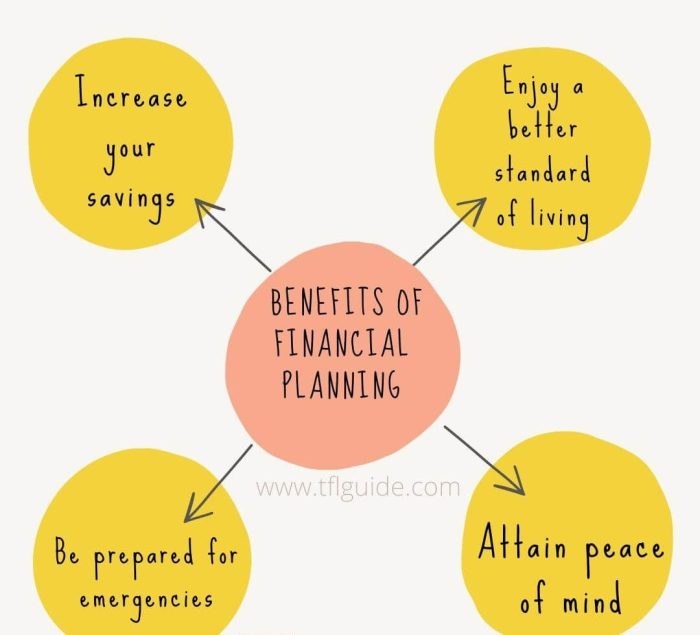

Benefits of Having a Well-Thought-Out Financial Plan

Having a well-thought-out financial plan comes with a myriad of benefits:

- 1. Setting Clear Financial Goals: A financial plan helps individuals set specific and achievable financial goals, whether it’s buying a house, saving for retirement, or starting a business.

- 2. Budgeting and Expense Management: With a financial plan, individuals can track their income and expenses, identify areas where they can cut costs, and allocate funds towards their priorities.

- 3. Building Wealth and Savings: A financial plan includes strategies for saving and investing money, allowing individuals to build wealth over time and secure their financial future.

- 4. Risk Management: Financial planning also involves assessing and managing risks such as emergencies, health issues, or market fluctuations, ensuring individuals are prepared for unforeseen circumstances.

- 5. Peace of Mind: By having a financial plan in place, individuals can have peace of mind knowing that they have a roadmap to achieve their financial goals and weather any financial storms that may come their way.

Consequences of Not Having a Financial Plan

The repercussions of not having a financial plan can be severe:

- 1. Financial Instability: Without a plan, individuals may struggle to make ends meet, accumulate debt, and live paycheck to paycheck, leading to financial instability and stress.

- 2. Missed Opportunities: Without a clear financial roadmap, individuals may miss out on opportunities for growth and prosperity, such as investments, career advancements, or retirement savings.

- 3. Inadequate Savings: Lack of a financial plan can result in inadequate savings for emergencies, retirement, or other financial goals, leaving individuals vulnerable to financial hardships in the future.

- 4. Uncertainty and Anxiety: Not having a financial plan can create uncertainty and anxiety about the future, making it challenging to make informed financial decisions and plan for long-term financial security.

Setting Financial Goals

Setting financial goals is a crucial aspect of financial planning as it gives individuals a clear direction and purpose for managing their finances effectively. By setting both short-term and long-term financial goals, individuals can prioritize their spending, saving, and investing activities to achieve financial stability and success.

Short-Term Financial Goals

Short-term financial goals typically involve plans and targets that can be achieved within a year or less. These goals are usually focused on immediate needs and desires, such as building an emergency fund, paying off credit card debt, or saving for a vacation. By setting short-term financial goals, individuals can create a sense of accomplishment and motivation to continue their financial journey.

- Building an emergency fund to cover unexpected expenses

- Paying off high-interest debt, such as credit card balances

- Creating a budget and sticking to it each month

Long-Term Financial Goals

Long-term financial goals are plans that require more time and dedication to achieve, often spanning several years or even decades. These goals are usually focused on major milestones, such as buying a home, saving for retirement, or funding a child’s education. Financial planning plays a crucial role in helping individuals break down these long-term goals into manageable steps and stay on track to reach them.

- Saving for a down payment on a house or property

- Investing in a retirement account, such as a 401(k) or IRA

- Setting up a college fund for children’s education

Overall, setting financial goals with the help of financial planning allows individuals to prioritize their spending, track their progress, and make informed decisions to achieve their desired financial outcomes. By having a clear roadmap in place, individuals can work towards a secure financial future and accomplish their dreams and aspirations.

Budgeting and Saving

Budgeting is a crucial aspect of financial planning as it helps individuals track their income and expenses, allowing them to allocate funds wisely to meet their financial goals. Saving money effectively is also essential for building wealth and achieving financial stability.

Role of Budgeting in Financial Planning

- Creating a budget helps individuals understand where their money is going and identify areas where they can cut back on expenses.

- It enables people to prioritize their financial goals and allocate funds accordingly, ensuring that they are working towards their objectives.

- By establishing a budget, individuals can avoid overspending, accumulate savings, and prepare for unexpected expenses or emergencies.

Strategies for Saving Money Effectively

- Automate your savings by setting up automatic transfers from your checking account to a savings account each month.

- Track your expenses and identify areas where you can reduce spending, such as dining out less frequently or cutting back on subscription services.

- Take advantage of employer-sponsored retirement plans or investment accounts to save for the future and benefit from potential tax advantages.

Tips for Creating and Maintaining a Budget

- Start by listing all sources of income and fixed expenses, such as rent or mortgage payments, utilities, and insurance.

- Allocate a portion of your income to savings and set aside funds for discretionary expenses like entertainment or dining out.

- Regularly review and adjust your budget as needed to reflect changes in income or expenses, ensuring that you stay on track with your financial goals.

Investing and Wealth Building

Investing in wealth building is crucial for individuals looking to secure their financial future and achieve their long-term financial goals. By investing wisely, individuals can grow their wealth over time and create a source of passive income.

Comparison of Investment Options

- Stock Market: Investing in stocks can offer high returns but comes with high risk. It’s essential to diversify your portfolio to minimize risk.

- Real Estate: Investing in real estate properties can provide a steady source of income through rental payments and potential appreciation in property value.

- Bonds: Bonds are considered safer investments compared to stocks, offering a fixed interest rate over a specified period.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

How Financial Planning Helps with Investment Decisions

Financial planning plays a vital role in helping individuals make informed investment decisions by:

- Setting Clear Goals: Financial planning helps individuals identify their financial goals and risk tolerance, guiding them in choosing suitable investment options.

- Creating a Diversified Portfolio: Through financial planning, individuals can create a diversified investment portfolio that spreads risk across different asset classes.

- Monitoring Progress: Regularly reviewing and adjusting investment strategies based on changing financial goals and market conditions is essential for long-term success.