Let’s dive into the world of budgeting methods, exploring the best strategies to manage your finances effectively. From zero-based budgeting to the 50/30/20 rule, we’ll cover it all in this comprehensive guide.

Get ready to revolutionize the way you handle your money and achieve your financial goals with these top budgeting methods.

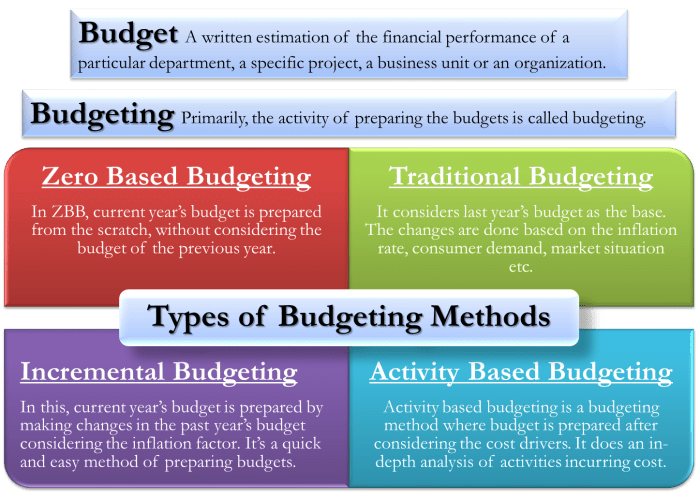

Overview of Budgeting Methods

Budgeting is the process of creating a plan for how you will spend your money. It is important because it helps you track your expenses, save money, and reach your financial goals. There are several budgeting methods that individuals can use to manage their finances effectively.

Zero-Based Budgeting

Zero-based budgeting requires you to allocate every dollar of your income towards a specific category, such as bills, savings, or entertainment. This method ensures that you are aware of where every dollar is going and helps eliminate unnecessary expenses.

50/30/20 Rule

The 50/30/20 rule suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings. This method provides a simple guideline for balancing essential expenses, discretionary spending, and saving for the future.

Envelope System

The envelope system involves allocating a specific amount of cash to different categories, such as groceries, entertainment, and transportation, and placing the cash in separate envelopes. Once an envelope is empty, you cannot spend any more money in that category until the next budgeting period.

Creating a Budget

Creating a budget is essential for managing your finances effectively. It involves setting clear financial goals, tracking expenses, and making sure you stick to your budget.

Setting Financial Goals

Setting financial goals is the first step in creating a budget. It helps you prioritize your spending and gives you a clear direction. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having specific goals will motivate you to stick to your budget.

- Identify your short-term and long-term financial goals.

- Set realistic and achievable goals that align with your income.

- Track your progress regularly and adjust your budget as needed to reach your goals.

Tracking Expenses

Tracking your expenses is crucial to ensure you stay within your budget. It helps you identify areas where you may be overspending and allows you to make necessary adjustments to stay on track.

- Keep a detailed record of all your expenses, including small purchases.

- Use budgeting apps or spreadsheets to categorize your expenses and monitor your spending.

- Regularly review your spending habits and look for ways to cut costs.

Best Budgeting Apps and Tools

Budgeting apps and tools can be extremely helpful in managing your finances effectively. They provide a convenient way to track expenses, set financial goals, and stay within your budget. Here are some popular budgeting apps and tools that are available for free or at a low cost:

Mint

Mint is a comprehensive budgeting app that allows you to track your spending, create budgets, and set financial goals. It also provides personalized financial insights and alerts to help you make better financial decisions.

You Need A Budget (YNAB)

YNAB is a budgeting tool that focuses on giving every dollar a job. It helps you prioritize your spending, eliminate debt, and save more money. YNAB also offers live workshops and support to help you succeed in managing your finances.

PocketGuard

PocketGuard is a budgeting app that gives you a snapshot of your financial situation in one place. It categorizes your spending, tracks your bills, and helps you optimize your budget. PocketGuard also offers tips on how to save money and reach your financial goals.

GoodBudget

GoodBudget is a budgeting app based on the envelope system, where you allocate money to different spending categories. It allows you to share budgets with family or friends and syncs across multiple devices. GoodBudget is great for those who prefer a simple and collaborative budgeting approach.

Tips for Maximizing Budgeting Apps

– Regularly update your transactions to stay on top of your spending.

– Use the goal-setting features to track your progress and stay motivated.

– Take advantage of the budgeting insights and tips provided by the app.

– Sync your accounts for automatic transaction tracking and categorization.

– Review your budget regularly to make adjustments and ensure you’re on track to meet your financial goals.

Strategies for Saving Money

Saving money is a crucial part of budgeting and financial planning. By implementing various strategies, you can build your savings over time and achieve your financial goals.

Cutting Expenses

One effective way to save money is by cutting down on unnecessary expenses. This could involve reducing dining out, canceling unused subscriptions, or finding more affordable alternatives for everyday items.

Increasing Income

Another strategy is to find ways to increase your income. This could be through taking on a side hustle, freelancing, or asking for a raise at your current job. By boosting your income, you can allocate more funds towards savings.

Automating Savings

Automating your savings is a great way to prioritize saving within your budget. Set up automatic transfers from your checking account to your savings account each month. This way, you won’t even have to think about it, and your savings will grow consistently.

Setting Savings Goals

It’s important to set specific savings goals to give you something to work towards. Whether it’s saving for a vacation, emergency fund, or retirement, having clear goals can motivate you to stick to your budget and save diligently.

Reducing Debt

Paying off high-interest debt can also free up more money for savings in the long run. By reducing your debt burden, you’ll have more financial flexibility to allocate towards your savings goals.