Step into the world of Online brokerage platforms, where investing meets innovation and convenience. From revolutionizing traditional methods to providing real-time data, these platforms offer a gateway to financial success in the digital age.

As we dive deeper into the features, investment options, security measures, and trading tools, you’ll discover a wealth of information to enhance your investment journey.

Introduction to Online Brokerage Platforms

Online brokerage platforms are digital platforms that allow individuals to buy and sell financial securities, such as stocks, bonds, and mutual funds, through the internet. These platforms have revolutionized the way people invest by providing easy access to the financial markets from anywhere in the world.

By eliminating the need for traditional brick-and-mortar brokerage firms, online brokerage platforms have made investing more affordable, convenient, and accessible to a wider range of individuals. Investors can now make trades in real-time, access research tools, and monitor their portfolios all from the comfort of their own homes.

Benefits of Using Online Brokerage Platforms

- Lower Fees: Online brokerage platforms typically have lower fees and commissions compared to traditional brokers, allowing investors to save money on transactions.

- Convenience: Investors can trade anytime, anywhere, without the need to visit a physical brokerage office, making investing more convenient and flexible.

- Access to Research Tools: Online brokerage platforms provide investors with access to a wealth of research tools, educational resources, and market analysis to help them make informed investment decisions.

- Control and Transparency: Investors have more control over their investments and can track their portfolio performance in real-time, providing greater transparency and visibility into their holdings.

Features of Online Brokerage Platforms

Online brokerage platforms offer a variety of features to help investors trade stocks, bonds, and other securities. These features are designed to provide users with the tools and information they need to make informed investment decisions.

Key Features

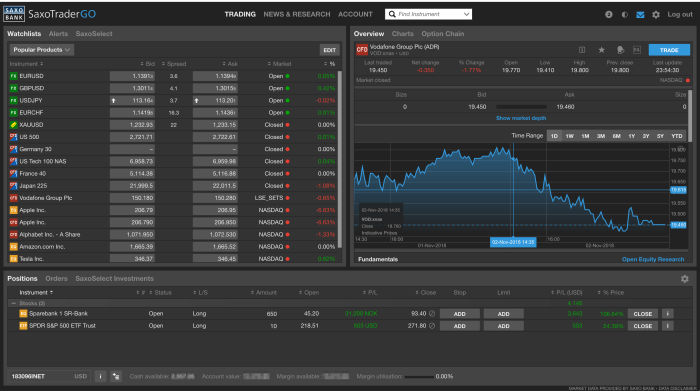

- Trading Tools: Online brokerage platforms typically offer a range of trading tools, including real-time stock quotes, interactive charts, and research reports.

- Account Management: Users can easily manage their investment accounts, track their portfolio performance, and access statements and tax documents.

- Mobile Apps: Many online brokerage platforms offer mobile apps that allow users to trade on-the-go and stay connected to the markets.

- Educational Resources: Some platforms provide educational resources such as webinars, tutorials, and articles to help investors learn more about trading and investing.

- Customer Support: Online brokerage platforms offer customer support through phone, email, and live chat to assist users with any questions or issues.

User Interface

Different online brokerage platforms have varying user interfaces, ranging from simple and intuitive designs to more complex layouts with advanced features. Some platforms prioritize ease of use and accessibility, while others cater to experienced traders with customizable tools and advanced charting capabilities.

Real-Time Data and Market Information

Online brokerage platforms provide users with real-time data on stock prices, market trends, and news updates to help them make informed trading decisions. By accessing up-to-date information, investors can react quickly to market changes and adjust their strategies accordingly.

Types of Investment Options Offered

When using online brokerage platforms, investors have access to a wide range of investment options to build their portfolios and achieve their financial goals. Diversification and catering to different risk appetites are key factors to consider when choosing from the various investment options available.

Stocks

- Investors can buy shares of individual companies, allowing them to participate in the growth and success of those specific companies.

- Stocks offer the potential for capital appreciation and dividends, but they also come with higher volatility and risk compared to other investment options.

- Online brokerage platforms provide access to a wide selection of stocks listed on major stock exchanges around the world.

ETFs (Exchange-Traded Funds)

- ETFs are investment funds that trade on stock exchanges, representing a diversified portfolio of assets such as stocks, bonds, or commodities.

- Investors can easily achieve diversification by investing in ETFs, as they provide exposure to multiple securities within a single investment.

- Online brokerage platforms offer a variety of ETFs covering different sectors, regions, and investment strategies.

Options

- Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period.

- Options can be used for hedging, speculation, or generating income, but they require a good understanding of risk management strategies.

- Online brokerage platforms provide options trading tools and resources for investors interested in derivatives trading.

Diversification is essential to reduce risk and protect against market volatility.

Online brokerage platforms offer a range of investment options to cater to different risk appetites, from conservative investors seeking stable returns to aggressive traders looking for high-risk, high-reward opportunities.

Security Measures on Online Brokerage Platforms

Online brokerage platforms prioritize the security of user data to prevent unauthorized access and protect sensitive information from cyber threats.

Security Protocols Implemented

- Secure Socket Layer (SSL) Encryption: Most online brokerage platforms use SSL encryption to secure data transmission between users and the platform servers.

- Firewalls: Firewalls are implemented to monitor and control incoming and outgoing network traffic, blocking unauthorized access.

- Multi-Factor Authentication: Two-factor authentication (2FA) is often required to add an extra layer of security by verifying user identity through a second form of authentication, such as a code sent to a mobile device.

- Regular Security Audits: Platforms conduct routine security audits to identify vulnerabilities and ensure compliance with security standards.

Comparison of Security Features

- Platform A: Implements end-to-end encryption for all user data and offers biometric authentication for secure login.

- Platform B: Utilizes advanced AI algorithms to detect and prevent potential security threats in real-time.

- Platform C: Provides a secure virtual private network (VPN) for users to connect securely and encrypt their internet connection.

Importance of Two-Factor Authentication and Encryption

-

Two-factor authentication adds an additional layer of security by requiring something you know (password) and something you have (phone or token), reducing the risk of unauthorized access.

-

Encryption ensures that data is scrambled during transmission, making it unreadable to unauthorized parties and maintaining the privacy of sensitive information.

Trading Tools and Resources

Online brokerage platforms offer a variety of trading tools and resources to assist users in making informed investment decisions. These tools are designed to provide valuable insights and analysis to help users navigate the complex world of stock trading.

Charting Tools

- Charting tools allow users to visualize historical price movements of stocks, helping them identify trends and patterns that can inform their trading decisions.

- Users can customize charts with different technical indicators and drawing tools to conduct in-depth analysis of stock performance.

- Real-time charting tools provide up-to-date information on stock prices, volume, and other key metrics to help users stay informed.

Research Reports

- Research reports prepared by financial experts offer detailed analysis and recommendations on specific stocks or sectors, guiding users on potential investment opportunities.

- Users can access company profiles, financial statements, and market news through research reports to stay updated on relevant information affecting their investments.

- Research reports often include buy, sell, or hold recommendations based on thorough analysis of market trends and stock performance.

Educational Resources

- Online brokerage platforms provide educational resources such as articles, tutorials, and webinars to help novice investors understand the basics of investing.

- Users can learn about investment strategies, risk management, and portfolio diversification through these resources to build their knowledge and confidence in trading.

- Educational resources also cover topics like fundamental analysis, technical analysis, and market trends to enhance users’ understanding of the stock market.

Fees and Commissions

When using online brokerage platforms, it’s important to understand the fee structures and commissions associated with them. These costs can vary depending on the platform you choose and the services you utilize.

Fee Structures of Various Online Brokerage Platforms

Online brokerage platforms typically charge fees in various ways, such as:

- Commission per trade: Some platforms charge a fee for each trade you make, which can range from a flat rate to a percentage of the transaction amount.

- Account maintenance fees: Certain platforms may charge a monthly or annual fee for maintaining your account.

- Additional fees: There can be additional charges for services like broker-assisted trades, wire transfers, or inactivity fees.

Comparing Fee Models

It’s essential to compare the fee models of different online brokerage platforms to find the most cost-effective option for your investment needs. Factors to consider include:

- Commission rates: Compare the commission fees per trade and see how they align with your trading frequency and investment size.

- Account fees: Look at account maintenance fees and any other charges that may apply to your account.

- Additional charges: Consider any extra fees that may impact your overall investment costs.

Evaluating Cost-Effectiveness

When evaluating the cost-effectiveness of using a particular online brokerage platform, consider the following:

- Trading volume: If you trade frequently, lower commission rates can save you money in the long run.

- Account balance: Some platforms offer fee waivers or discounts based on your account balance.

- Services offered: Compare the fees against the services and tools provided by the platform to determine if it’s worth the cost.

Customer Support and Service

Customer support is a crucial aspect of online brokerage platforms, as it provides assistance and guidance to users navigating the platform and making investment decisions. Responsive customer service is essential in the context of online trading, as timely support can help users resolve issues quickly and make informed decisions. Here are some tips on assessing the quality of customer support offered by different platforms:

Available Support Options

- Phone Support: Look for platforms that offer phone support for immediate assistance.

- Chat Support: Live chat can be convenient for quick queries and support.

- Email Support: Email support is useful for non-urgent inquiries and documentation.

Importance of Responsive Service

Responsive customer service can help prevent financial losses and ensure a seamless trading experience for users.

Tips for Assessing Customer Support

- Response Time: Evaluate how quickly customer support responds to queries or issues.

- Quality of Responses: Assess the helpfulness and accuracy of the responses provided by customer support agents.

- Availability: Check the availability of customer support options, especially during trading hours.

- User Reviews: Look for feedback from other users to gauge the overall satisfaction with customer support services.