Diving deep into the realm of Types of retirement accounts, we take a cool and trendy look at the most common options available for securing your financial future. From Traditional IRAs to Roth IRAs and 401(k) plans, we’ve got you covered with all the details you need to know.

Types of Retirement Accounts

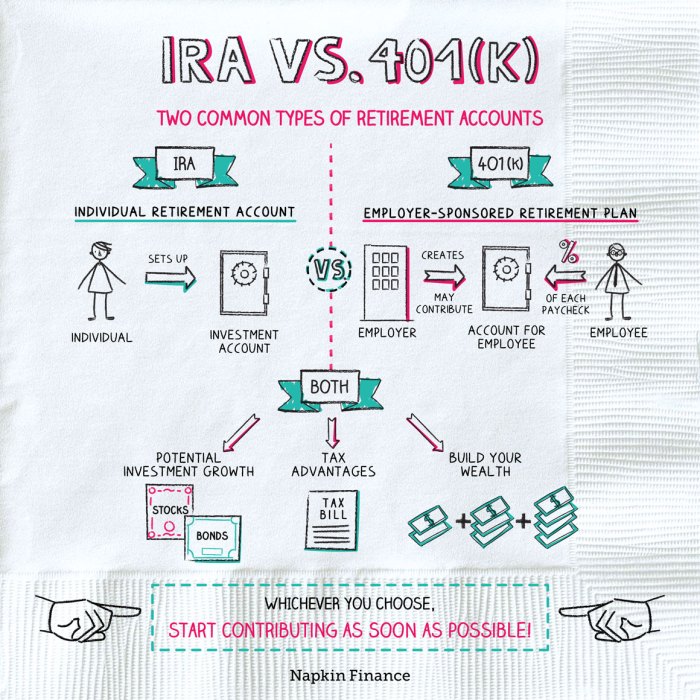

Retirement accounts are essential for individuals to save for their future financial needs. The most common types of retirement accounts include Traditional IRAs, Roth IRAs, and 401(k) plans. Each type has its own unique features and eligibility criteria.

Traditional IRAs

Traditional IRAs are tax-deferred retirement accounts where contributions are tax-deductible. The earnings in the account grow tax-deferred until withdrawal during retirement. Individuals must be under the age of 70 ½ to contribute to a Traditional IRA, and there are no income limits for eligibility.

Roth IRAs

Roth IRAs are funded with after-tax dollars, meaning contributions are not tax-deductible. However, earnings grow tax-free, and qualified withdrawals are tax-free as well. To contribute to a Roth IRA, individuals must meet income requirements, and there are no age limits for contributions.

401(k) Plans

401(k) plans are employer-sponsored retirement accounts where employees can contribute a portion of their salary. Contributions are typically tax-deferred, and employers may match a percentage of the employee’s contributions. Eligibility for a 401(k) plan is based on employment status and specific plan requirements.

Traditional IRAs

Traditional Individual Retirement Accounts (IRAs) are a type of retirement account where individuals can save for their retirement while enjoying potential tax benefits. Contributions made to a Traditional IRA are often tax-deductible, meaning they can lower your taxable income for the year in which you contribute.

How Traditional IRAs Work and Tax Implications

Traditional IRAs allow individuals to contribute pre-tax dollars to their retirement savings, which can grow tax-deferred until withdrawal during retirement. When funds are withdrawn in retirement, they are taxed as ordinary income based on your tax bracket at that time.

Contribution Limits and Age Restrictions

For 2021, individuals under the age of 50 can contribute up to $6,000 to a Traditional IRA, while those 50 and older can contribute up to $7,000. It’s important to note that there are income limits that may affect your ability to deduct contributions to a Traditional IRA if you are covered by a retirement plan at work.

Benefits and Drawbacks of Investing in a Traditional IRA

– Benefits:

– Potential tax deduction on contributions

– Tax-deferred growth on investments

– Ability to lower current taxable income

– Drawbacks:

– Required minimum distributions (RMDs) starting at age 72

– Taxes owed on withdrawals in retirement

– Limited investment options compared to other retirement accounts

Roth IRAs

Roth IRAs are retirement accounts that offer tax-free growth on your investments. Unlike Traditional IRAs, contributions to Roth IRAs are made with after-tax dollars, meaning you don’t get a tax deduction when you contribute. However, the key advantage of Roth IRAs lies in how withdrawals are taxed.

Tax Advantages of Roth IRAs

Roth IRAs offer tax-free withdrawals in retirement, as long as you meet certain conditions. This means that all the money you withdraw from your Roth IRA, including investment earnings, is not subject to federal income tax. This can be a huge benefit for individuals who anticipate being in a higher tax bracket during retirement or want to diversify their tax strategy.

Benefits of Investing in a Roth IRA

- Roth IRAs are ideal for young investors who have many years for their investments to grow tax-free.

- Individuals who expect their income to increase significantly in the future may benefit from the tax-free withdrawals of a Roth IRA.

- Roth IRAs can serve as a hedge against future tax rate increases, providing a source of tax-free income in retirement.

401(k) Plans

A 401(k) plan is a retirement savings account sponsored by an employer that allows employees to save and invest a portion of their paycheck before taxes are taken out. This money can then grow tax-deferred until withdrawal during retirement.

Employer Match Concept

Employer match is when an employer contributes a certain amount to an employee’s 401(k) account based on the employee’s own contributions. This is essentially free money added to the employee’s retirement savings, encouraging them to save more for their future.

Traditional 401(k) vs. Roth 401(k)

– In a traditional 401(k) plan, contributions are made with pre-tax dollars, reducing the employee’s taxable income for that year. However, withdrawals during retirement are taxed as ordinary income.

– On the other hand, a Roth 401(k) plan involves contributions made with after-tax dollars, meaning withdrawals during retirement are tax-free. This can be beneficial for individuals expecting to be in a higher tax bracket in the future.