Get ready to dive into the world of Credit union benefits, where financial perks and community involvement collide in a dynamic way. Let’s explore the unique advantages that credit unions offer over traditional banks, setting the stage for a financial journey like no other.

Benefits of Credit Unions

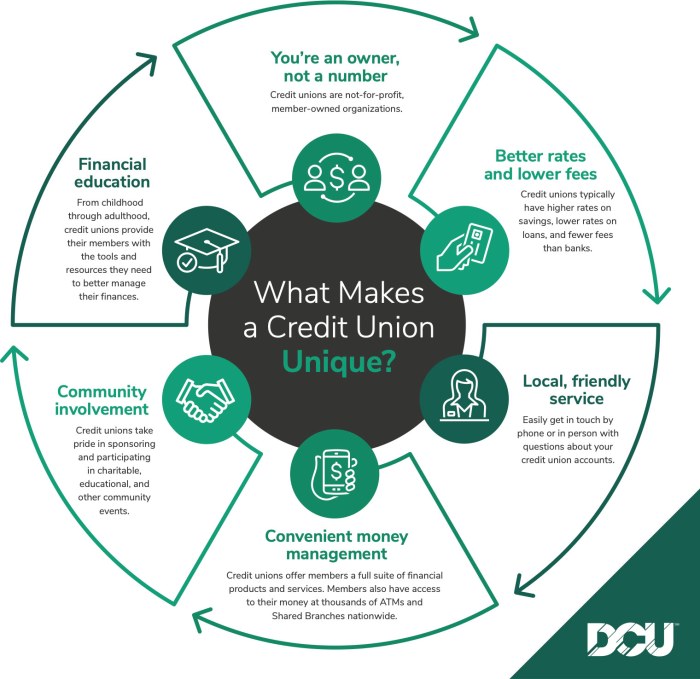

Credit unions are financial institutions that are owned and operated by their members, with a focus on providing financial services to their community. Unlike traditional banks, credit unions are not-for-profit organizations, which means they can offer lower fees, better interest rates, and personalized customer service.

Services Offered by Credit Unions

- Savings and checking accounts with competitive interest rates

- Loans for various purposes such as auto, home, and personal loans

- Credit cards with lower interest rates compared to banks

- Financial education and counseling services

- Online and mobile banking for convenient access to accounts

Comparison with Traditional Banks

- Credit unions typically offer higher interest rates on savings accounts and lower interest rates on loans compared to traditional banks.

- Members of credit unions have a say in the decision-making process and can benefit from personalized customer service.

- Credit unions are focused on serving their community, which can result in a more customer-friendly approach compared to banks.

Membership Advantages

Joining a credit union is a great way to access financial services while also becoming part of a community-focused organization. Here are some of the advantages of being a member of a credit union:

Requirements for Joining a Credit Union

To join a credit union, individuals usually need to meet specific eligibility criteria based on factors like where they live, work, or associations they belong to. Some common requirements include living in a certain geographic area, being employed by a specific company, or having a family member who is already a member.

Benefits of Being a Credit Union Member

- Lower Fees and Better Rates: Credit unions often offer lower fees and better interest rates on loans and savings accounts compared to traditional banks.

- Member Ownership: Credit union members are also owners of the institution, which means they have a say in how the credit union operates and may receive dividends based on profits.

- Personalized Service: Credit unions are known for their personalized customer service, as they prioritize member satisfaction over profits.

- Community Involvement: Credit unions are deeply rooted in the communities they serve, often supporting local initiatives and giving back to their members.

Promotion of Financial Literacy

Credit unions are committed to promoting financial literacy and education among their members through various initiatives such as:

- Financial Workshops: Credit unions offer workshops and seminars on topics like budgeting, saving, and investing to help members make informed financial decisions.

- Youth Programs: Many credit unions have programs specifically designed to educate young members about money management and financial responsibility.

- Online Resources: Credit unions provide online resources and tools to help members improve their financial literacy skills and make sound financial choices.

Lower Fees and Interest Rates

Credit unions are known for offering lower fees on accounts and loans compared to traditional banks. This can result in significant savings for members over time.

Lower Account Fees

At credit unions, members often enjoy lower fees for services such as overdrafts, ATM transactions, and monthly account maintenance. For example, overdraft fees at credit unions are typically lower than those at banks, helping members avoid costly penalties.

Lower Loan Fees

When it comes to loans, credit unions generally charge lower fees for origination, application, and prepayment compared to banks. This can make borrowing more affordable for members and help them save money in the long run.

Competitive Interest Rates

Credit unions also offer competitive interest rates on savings accounts and loans. Members can earn higher returns on their savings and enjoy lower interest costs on loans, making credit unions an attractive option for those looking to maximize their financial benefits.

Community Involvement

Credit unions are known for their strong commitment to giving back to the community they serve. Unlike traditional banks, credit unions prioritize community involvement and support various initiatives that benefit local neighborhoods and residents.

Supporting Local Initiatives

- Credit unions often sponsor local events such as charity runs, food drives, and community fairs to help raise funds for important causes.

- They also partner with non-profit organizations to support educational programs, healthcare initiatives, and environmental conservation efforts.

- Many credit unions offer scholarships to students in the community, helping to invest in the future generation and promote higher education.

Employee Volunteer Programs

- Credit unions encourage their employees to volunteer their time and skills to support community projects and initiatives.

- Employees may participate in activities like mentoring youth, organizing clean-up campaigns, or serving at local shelters to make a positive impact.

Financial Literacy Programs

- Credit unions often provide free financial education workshops and seminars to help community members improve their money management skills.

- These programs cover topics such as budgeting, saving, credit building, and investing, empowering individuals to make informed financial decisions.

Differentiating Factor

Credit unions stand out from traditional banks by actively engaging with the community and focusing on the well-being of their members beyond financial services. Their commitment to supporting local initiatives, encouraging employee volunteerism, and promoting financial literacy sets them apart as institutions that truly care about the communities they serve.