Get ready to dive into the world of Financial planning for small businesses. Buckle up as we explore the ins and outs of why financial planning is crucial and how it can make or break a small business’s success.

Let’s break down the components of a comprehensive financial plan and discover the strategies and tools that can help small businesses thrive in the competitive market.

Importance of Financial Planning for Small Businesses

Financial planning is crucial for the success of small businesses as it helps in managing resources effectively, setting realistic goals, and ensuring long-term sustainability. Without a solid financial plan in place, small businesses may struggle to make informed decisions, allocate funds efficiently, and adapt to changing market conditions.

Effective Financial Planning for Small Businesses

- Forecasting cash flow: By creating a cash flow forecast, small businesses can anticipate financial challenges, plan for upcoming expenses, and maintain a healthy cash flow to cover operational costs.

- Budgeting and expense tracking: Establishing a budget and tracking expenses can help small businesses identify areas of overspending, cut unnecessary costs, and allocate resources to high-priority activities.

- Investment and growth opportunities: With a financial plan, small businesses can identify opportunities for growth, whether through strategic investments, expansion plans, or new product development.

Risks of Not Having a Solid Financial Plan

- Financial instability: Without a clear financial plan, small businesses may face cash flow shortages, debt accumulation, and difficulty in securing funding for growth or emergencies.

- Lack of strategic direction: A lack of financial planning can lead to a lack of direction in terms of business goals, investment decisions, and overall growth strategies.

- Inability to react to market changes: Small businesses without a financial plan may struggle to adapt to market fluctuations, competitive pressures, or unexpected events that require financial resources.

- Set financial goals: Establishing clear financial goals is important for small businesses to work towards achieving profitability and growth.

- Monitor cash flow: Tracking cash flow through budgeting helps in identifying any cash shortages or surpluses, allowing businesses to make informed decisions.

- Control expenses: Budgeting helps in controlling expenses by setting limits on spending in different areas of the business, ultimately improving financial performance.

- Plan for future investments: By budgeting for future investments, businesses can ensure they have the necessary funds available when opportunities arise.

- Identify trends: Forecasting helps in identifying trends in sales, expenses, and market conditions, allowing businesses to adapt their strategies accordingly.

- Risk management: Financial analysis helps in assessing risks and uncertainties that may impact the business, enabling businesses to implement risk mitigation strategies.

- Strategic decision-making: By conducting financial analysis, businesses can make strategic decisions based on data-driven insights, leading to improved financial performance.

- Evaluate performance: Regular financial analysis helps in evaluating the performance of the business against set goals and making adjustments as needed to stay on track.

Components of a Comprehensive Financial Plan

Financial planning for small businesses involves several key components that are essential for the success and sustainability of the business. Let’s take a closer look at some of these components:

Budgeting

Budgeting is a crucial component of financial planning for small businesses as it helps in setting financial goals, allocating resources effectively, and monitoring expenses. By creating a detailed budget, businesses can track their income and expenses, identify areas of overspending, and make necessary adjustments to ensure financial stability.

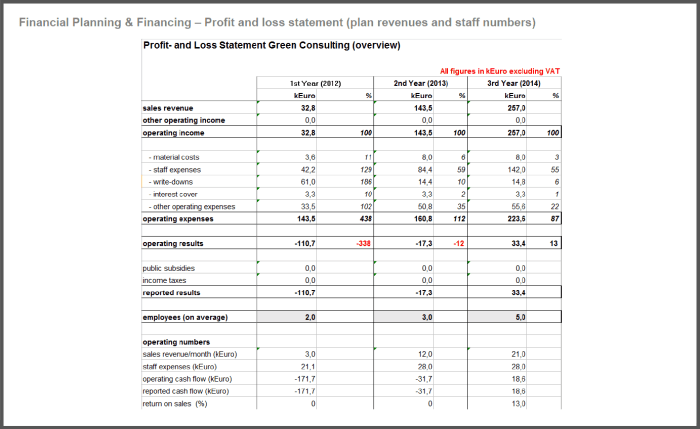

Forecasting and Financial Analysis

Forecasting and financial analysis play a crucial role in developing a financial plan for small businesses. By analyzing past financial data and market trends, businesses can make informed projections about future financial performance and develop strategies to achieve their financial goals.

Strategies for Financial Management in Small Businesses

Effective financial management is crucial for the success of small businesses. By implementing the right strategies, small business owners can ensure the proper allocation of resources and maintain financial stability.

Cash Flow Management

Cash flow management is a key component of financial management for small businesses. It involves monitoring the flow of cash in and out of the business to ensure that there is enough liquidity to cover expenses and investments. By maintaining a healthy cash flow, small businesses can avoid financial crises and make informed decisions about their operations.

Setting Financial Goals and Milestones

Setting financial goals and milestones is essential for small businesses to track their progress and stay on course. By establishing clear objectives, small business owners can create a roadmap for financial success and measure their performance against predefined targets. This helps in making strategic decisions and adjusting financial strategies as needed to achieve long-term growth.

Tools and Resources for Financial Planning

Financial planning is essential for the success of small businesses. To effectively carry out financial planning, small businesses can utilize various tools and resources to streamline the process and make informed decisions.

Accounting Software and Financial Management Platforms

Using accounting software and financial management platforms can greatly benefit small businesses in their financial planning efforts. These tools offer features such as budget tracking, invoicing, expense management, and financial reporting. By automating these tasks, small businesses can save time, reduce errors, and have a better overall view of their financial health.

Financial Planning Guides and Templates

Small businesses can also benefit from financial planning guides and templates that provide step-by-step instructions and frameworks for creating comprehensive financial plans. These resources can help businesses understand key financial concepts, set financial goals, and develop strategies to achieve them. By following these guides and utilizing templates, small businesses can establish a solid financial foundation and make informed decisions.

Financial Planning Workshops and Seminars

Attending financial planning workshops and seminars can be invaluable for small businesses looking to enhance their financial planning skills. These events often cover topics such as cash flow management, financial forecasting, risk management, and investment strategies. By participating in these workshops, small business owners can gain practical knowledge, network with industry experts, and stay up-to-date on the latest trends and best practices in financial planning.