401(k) vs. IRA sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

When it comes to planning for retirement, knowing the differences between a 401(k) and an IRA is essential. From contribution limits to investment options, these two retirement savings accounts offer unique benefits and features that can impact your financial future.

Overview of 401(k) and IRA

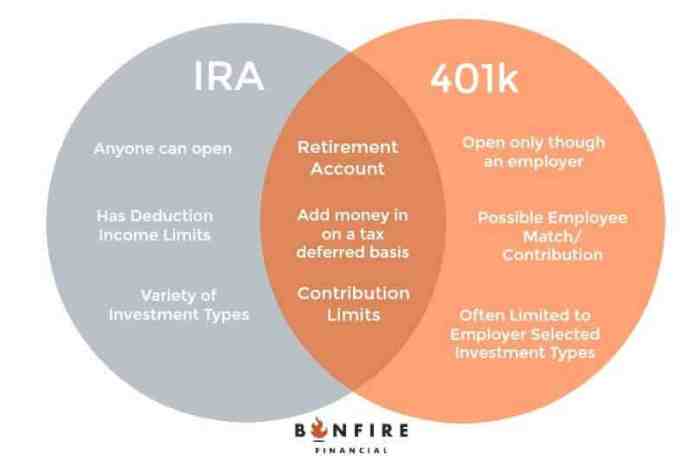

401(k) and IRA are both popular retirement savings accounts, but they have some key differences in terms of eligibility, contribution limits, and other features.

Main Differences

- 401(k) is typically offered by employers, while an IRA can be opened by an individual.

- 401(k) contributions are made through payroll deductions, while IRA contributions are made by the individual.

- 401(k) contributions may be matched by the employer, providing additional funds for retirement savings.

Eligibility Criteria

- 401(k): Generally, employees of companies that offer a 401(k) plan are eligible to participate. There may be minimum age and service requirements set by the employer.

- IRA: Individuals under the age of 70 ½ with earned income are eligible to open and contribute to an IRA.

Contribution Limits

- 401(k): In 2021, the annual contribution limit for a 401(k) is $19,500 for those under 50 years old and $26,000 for those 50 and older.

- IRA: The annual contribution limit for an IRA in 2021 is $6,000 for those under 50 and $7,000 for those 50 and older.

Types of 401(k) plans and IRAs

When it comes to planning for retirement, understanding the different types of 401(k) plans and IRAs is crucial. Each type comes with its own set of rules, tax implications, and benefits. Let’s dive into the details.

Types of 401(k) plans

- Traditional 401(k): This is the most common type of employer-sponsored retirement plan. Contributions are made with pre-tax dollars, reducing your taxable income in the year of contribution. Withdrawals are taxed as ordinary income in retirement.

- Roth 401(k): Contributions to a Roth 401(k) are made with after-tax dollars, so withdrawals in retirement are tax-free. This can be advantageous if you expect to be in a higher tax bracket when you retire.

- Solo 401(k): Designed for self-employed individuals, this plan allows both employer and employee contributions. It offers higher contribution limits than traditional or Roth 401(k) plans.

Types of IRAs

- Traditional IRA: Contributions to a traditional IRA are often tax-deductible, reducing your taxable income for the year. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, so withdrawals in retirement are tax-free. This can be beneficial if you anticipate being in a higher tax bracket when you retire.

- SEP IRA: Simplified Employee Pension (SEP) IRAs are designed for self-employed individuals or small business owners. Contributions are tax-deductible, and withdrawals in retirement are taxed as ordinary income.

- SIMPLE IRA: Savings Incentive Match Plan for Employees (SIMPLE) IRAs are employer-sponsored plans that allow both employer and employee contributions. Contributions are tax-deductible, and withdrawals are taxed as ordinary income in retirement.

It’s important to consider your current financial situation, future tax implications, and retirement goals when choosing between different types of 401(k) plans and IRAs.

Employer Matching and Contributions

When it comes to retirement savings, understanding how employer matching and contributions work in a 401(k) plan versus an IRA is crucial. Let’s dive into the details.

Employer matching in a 401(k) plan is when your employer contributes a certain amount to your retirement account based on the amount you contribute. For example, your employer may match 50% of your contributions up to a certain percentage of your salary. This is essentially free money that helps boost your retirement savings.

Benefits of Employer Contributions to a 401(k) Plan

- Boosts your retirement savings: Employer contributions help grow your retirement nest egg faster than relying solely on your own contributions.

- Tax advantages: The money contributed by your employer is tax-deferred, meaning you won’t pay taxes on it until you withdraw it in retirement.

- Encourages saving: Knowing that your employer is contributing to your retirement fund can motivate you to save more for your future.

How IRA Contributions Differ from Employer-Sponsored 401(k) Contributions

- IRA contributions are solely made by the individual: Unlike a 401(k) plan where employer contributions are possible, IRA contributions are made by the individual account holder without any employer involvement.

- Income limitations: While anyone with earned income can contribute to a traditional IRA, there are income limits for deducting contributions if you or your spouse has access to a workplace retirement plan.

- No employer match: Since IRAs are individual retirement accounts, there is no employer match like you would find in a 401(k) plan.

Investment options and flexibility

When it comes to investment options and flexibility, both 401(k) and IRA accounts offer a range of choices to help you grow your retirement savings. Let’s dive into the details of how they compare and the impact of investment performance on your future financial stability.

Investment Options in 401(k) vs. IRA

- 401(k): Many 401(k) plans offer a selection of mutual funds, stocks, bonds, and target-date funds for investment. These options are usually limited to what your employer provides.

- IRA: IRAs typically have a broader range of investment options including individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even real estate or precious metals through self-directed IRAs.

Flexibility of Investment Choices

- 401(k): The investment choices in a 401(k) are determined by your employer’s plan, limiting your ability to customize your portfolio. However, some plans may offer a self-directed brokerage option for more flexibility.

- IRA: IRAs offer more flexibility as you have control over where you invest your money. You can choose from a wide range of investment options based on your risk tolerance and financial goals.

Impact of Investment Performance

In both 401(k) and IRA accounts, the performance of your investments directly affects the growth of your retirement savings. Consistent investment performance can lead to significant gains over time, while poor performance may hinder your ability to reach your retirement goals. It’s essential to regularly review and adjust your investment strategy to maximize returns and secure your financial future.