Diving into the realm of 401(k) withdrawal penalties, buckle up as we explore the ins and outs of this financial maze with an American high school hip twist that will keep you hooked from start to finish.

Breaking down the complexities of penalties, exceptions, and tax implications, this guide will equip you with the knowledge needed to make informed decisions regarding your 401(k) withdrawals.

Overview of 401(k) Withdrawal Penalties

401(k) withdrawal penalties are fees imposed by the IRS on early withdrawals from a 401(k) retirement account. These penalties are designed to discourage individuals from tapping into their retirement savings before reaching a certain age or meeting specific criteria.

Types of Penalties Associated with Early Withdrawals

- Early Withdrawal Penalty: If you withdraw funds from your 401(k) before the age of 59 ½, you may be subject to an additional 10% penalty on top of regular income taxes.

- Income Tax: Any amount withdrawn from a 401(k) account is considered taxable income, which means you’ll have to pay income taxes on the funds withdrawn.

- Penalty Exemptions: There are certain circumstances, such as disability or medical expenses, that may exempt you from paying the early withdrawal penalty.

Reasons Why Penalties Apply to 401(k) Withdrawals

- Encouraging Retirement Savings: Penalties are in place to encourage individuals to save for retirement and not use their 401(k) as a short-term savings account.

- Tax Revenue: The IRS collects penalties and taxes on early 401(k) withdrawals to ensure they receive the appropriate tax revenue.

- Long-Term Financial Security: By penalizing early withdrawals, the IRS aims to promote long-term financial security and stability for individuals in retirement.

Early Withdrawal Penalties

When it comes to withdrawing funds from a 401(k) before the age of 59 1/2, there are penalties that individuals need to be aware of. These penalties are put in place to discourage individuals from accessing their retirement savings prematurely.

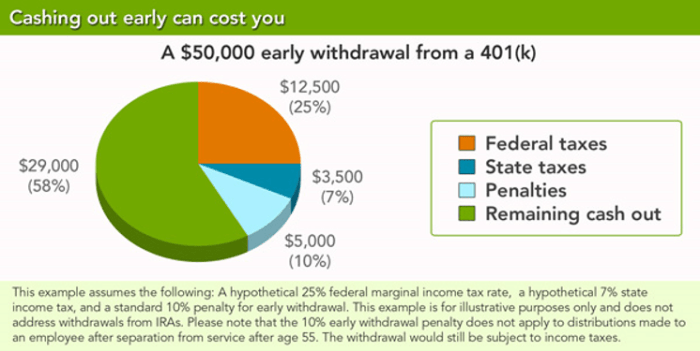

The penalties incurred for early withdrawal from a 401(k) typically include a 10% early withdrawal penalty on top of the regular income tax that is due on the withdrawn amount. This means that if you withdraw funds before the age of 59 1/2, you will not only have to pay income tax on the withdrawn amount but also an additional 10% penalty.

Penalties Calculation

- For example, if you withdraw $10,000 from your 401(k) before the age of 59 1/2 and you are in a 20% tax bracket, you would owe $2,000 in income tax ($10,000 x 0.20 = $2,000). On top of that, you would also owe a $1,000 early withdrawal penalty ($10,000 x 0.10 = $1,000).

- Therefore, in this scenario, your total penalties for early withdrawal would amount to $3,000 ($2,000 income tax + $1,000 early withdrawal penalty).

Traditional 401(k) vs. Roth 401(k)

When comparing the penalties for early withdrawal between traditional 401(k) plans and Roth 401(k) plans, there are some key differences to consider.

- In traditional 401(k) plans, both the withdrawn amount and any earnings are subject to income tax and the 10% early withdrawal penalty.

- On the other hand, in Roth 401(k) plans, contributions are made with after-tax dollars, so withdrawals of contributions are not subject to income tax or the 10% penalty. However, any earnings withdrawn before the age of 59 1/2 are subject to income tax and the penalty.

Exceptions to Penalty Rules

In certain circumstances, individuals can withdraw funds from a 401(k) without incurring penalties. These exceptions are designed to provide financial flexibility in times of need.

Medical Expenses

- Penalty-free withdrawals can be made for unreimbursed medical expenses that exceed 7.5% of your adjusted gross income.

- Documentation may be required to prove the medical necessity of the expenses.

First-Time Home Purchase

- You can withdraw up to $10,000 penalty-free from your 401(k) for a first-time home purchase.

- Requirements include being a first-time homebuyer or not having owned a home in the past two years.

Hardship Withdrawals

- If facing financial hardship, such as medical expenses, education costs, or prevention of eviction or foreclosure, you may qualify for a penalty-free withdrawal.

- Requirements vary by plan, but typically involve demonstrating financial need.

Loans from a 401(k)

- Instead of a withdrawal, you can take out a loan from your 401(k) without incurring penalties.

- Repayment terms and interest rates will apply, but this option allows you to access funds without penalties.

Tax Implications of Early Withdrawals

When it comes to early withdrawals from a 401(k), it’s essential to understand the tax implications involved. These withdrawals can have significant consequences on your finances, so it’s crucial to be aware of how they are taxed and how you can minimize these tax implications.

Tax Treatment of Traditional 401(k) vs. Roth 401(k) Withdrawals

When you make early withdrawals from a traditional 401(k), the amount withdrawn is subject to ordinary income tax. This means that the withdrawn funds are treated as taxable income for the year in which the withdrawal is made. Additionally, if you are under the age of 59 ½, you may also be subject to the early withdrawal penalty of 10%.

On the other hand, Roth 401(k) withdrawals work differently. Since contributions to a Roth 401(k) are made with after-tax dollars, qualified withdrawals (including those made before age 59 ½) are typically tax-free. However, any earnings withdrawn before reaching the age of 59 ½ may be subject to income tax and the early withdrawal penalty.

Strategies for Minimizing Tax Implications

One strategy to minimize tax implications when faced with 401(k) withdrawal penalties is to consider alternative sources of funds, if possible, to cover your financial needs without tapping into your retirement savings prematurely. This can help you avoid the tax consequences associated with early withdrawals.

Another approach is to explore options such as taking out a loan from your 401(k) instead of making a withdrawal. While this option also has its own set of considerations, it may be a more tax-efficient way to access funds temporarily without triggering immediate tax liabilities and penalties.