Get ready to dive into the world of budgeting like never before with our guide on How to create a budget. This isn’t your typical snooze-fest finance talk – we’re spicing things up with practical tips and real-life examples to help you master the art of budgeting like a pro.

From understanding the basics to managing debt and savings like a champ, we’ve got you covered every step of the way. So buckle up and get ready to take control of your finances in style.

Understanding Budgeting

Budgeting is the process of creating a plan to manage your money. It involves tracking your income and expenses to ensure that you are spending within your means and saving for the future. A budget is crucial in personal finance as it helps you take control of your finances, avoid overspending, and work towards your financial goals.

Importance of Budgeting

- Allows you to track where your money is going and identify areas where you can cut back on expenses.

- Helps you prioritize your spending and allocate funds towards savings, debt repayment, or other financial goals.

- Provides a clear roadmap for achieving short-term and long-term financial objectives.

Benefits of Creating and Following a Budget

- Helps you avoid living paycheck to paycheck and build an emergency fund for unexpected expenses.

- Enables you to make informed financial decisions and reduce financial stress.

- Allows you to save for big purchases or investments like a home, car, or retirement.

Examples of Achieving Financial Goals with a Budget

- By following a budget, you can save a certain percentage of your income each month towards a down payment on a house.

- A budget can help you pay off high-interest credit card debt faster by allocating extra funds towards debt repayment.

- Setting a budget for entertainment expenses can help you enjoy activities within your means without overspending.

Setting Financial Goals

Setting financial goals is a crucial step in creating a budget that works for you. By establishing both short-term and long-term financial goals, you can set a clear direction for your finances and track your progress along the way.

Short-term Financial Goals

Short-term financial goals typically focus on achieving specific outcomes within the next few months to a year. These goals can include building an emergency fund, paying off credit card debt, or saving for a vacation.

Long-term Financial Goals

Long-term financial goals are geared towards achieving larger milestones over an extended period, such as buying a house, retiring comfortably, or funding a child’s education. These goals require consistent effort and planning to reach.

Aligning Budget with Financial Goals

Aligning your budget with your financial goals involves allocating your income towards priorities that support your objectives. For example, if your goal is to save for a down payment on a home, you can adjust your budget to increase savings and reduce discretionary spending.

Examples of Common Financial Goals

1. Building an emergency fund to cover unexpected expenses.

2. Paying off student loans or credit card debt.

3. Saving for retirement and investing for long-term wealth.

4. Buying a car or home.

5. Funding a child’s education.

Tracking Income and Expenses

Tracking income and expenses is a crucial part of budgeting as it helps individuals understand their financial situation and make informed decisions about their spending habits.

Importance of Tracking Income Sources

- Accurately tracking income sources ensures that all sources of income are accounted for, providing a clear picture of available funds.

- It helps in identifying trends in income, such as fluctuations or changes in earnings over time.

- Tracking income sources can assist in setting realistic financial goals based on actual income levels.

Different Methods for Tracking Expenses

- Maintaining a written log or journal of expenses can help individuals keep track of every spending activity.

- Using budgeting apps or software can automate the process of tracking expenses and provide detailed reports on spending patterns.

- Keeping receipts and invoices organized can also be an effective method for tracking expenses.

Tips on Categorizing Expenses

- Create specific categories for expenses such as groceries, utilities, transportation, and entertainment to easily identify where money is being spent.

- Regularly review and update expense categories to reflect changes in spending habits and ensure accurate tracking.

- Utilize budgeting tools that offer customizable categories to tailor expenses to individual needs and preferences.

Creating a Budget Plan

When it comes to creating a budget plan, it’s essential to have a clear understanding of your total income and expenses for a specific period. By setting limits for each category, you can effectively manage your finances and work towards your financial goals. Here’s a guide on how to create a budget plan and take control of your money.

Calculating Total Income and Expenses

To create a budget plan, start by calculating your total income for the period. This includes all sources of income, such as your salary, bonuses, side hustles, or any other earnings. Next, list down all your expenses, including fixed expenses like rent, utilities, and loan payments, as well as variable expenses like groceries, entertainment, and transportation costs. Subtract your total expenses from your total income to determine how much you have left to allocate towards savings or other financial goals.

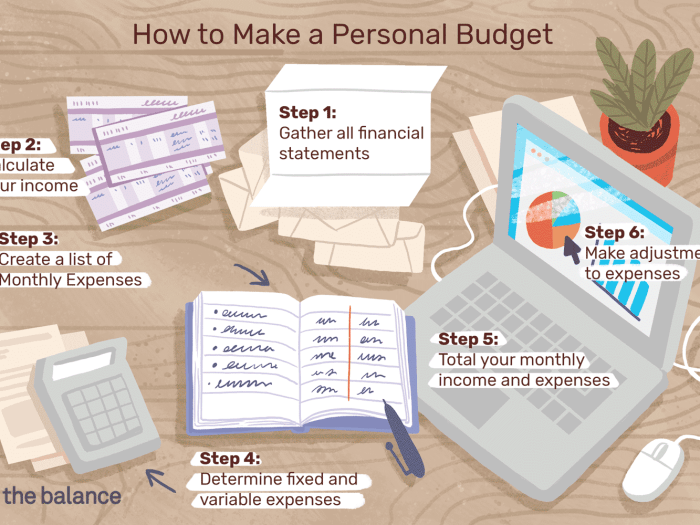

Steps in Creating a Budget Plan

- Identify all sources of income and list them down.

- Track your expenses by categorizing them into fixed and variable expenses.

- Set limits for each category based on your income and financial goals.

- Regularly review and adjust your budget plan to ensure you stay on track.

Budget Templates and Tools

There are many budget templates and tools available online that can help simplify the budget planning process. Some popular options include:

- Excel Budget Templates

- Mint

- You Need A Budget (YNAB)

- PocketGuard

These tools can assist you in tracking your income and expenses, setting budget limits, and monitoring your progress towards your financial goals.

Managing Debt and Savings

When it comes to managing debt and savings, it’s all about finding the right balance to secure your financial future. By prioritizing debt repayment and saving, you can set yourself up for long-term financial success.

Strategies for Managing Debt Within a Budget

- Identify all outstanding debts: Make a list of all your debts, including credit cards, loans, and any other obligations.

- Prioritize high-interest debts: Focus on paying off debts with the highest interest rates first to save money in the long run.

- Set a debt repayment goal: Establish a realistic timeline to pay off your debts while still meeting your other financial obligations.

- Consider debt consolidation: Explore options to consolidate your debts into a single, lower-interest loan to simplify repayment.

Paying Yourself First and Importance of Saving

- Allocate a portion of your income to savings: Make saving a priority by setting aside a percentage of your income before paying bills or expenses.

- Build an emergency fund: Save at least three to six months’ worth of living expenses in case of unexpected financial setbacks.

- Invest in your future: Save for retirement by contributing to a retirement account or employer-sponsored plan.

- Automate your savings: Set up automatic transfers to your savings account to ensure consistent saving habits.

Tips for Allocating Funds for Debt Repayment and Savings

- Create a budget: Track your income and expenses to determine how much you can allocate towards debt repayment and savings each month.

- Use the 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to debt repayment and savings.

- Adjust as needed: Regularly review and adjust your budget to accommodate changes in your financial situation or goals.

- Avoid new debt: Resist the temptation to take on new debt while focusing on debt repayment and saving goals.

Reviewing and Adjusting Budget

Regularly reviewing and adjusting a budget is crucial for financial success. It allows you to track your progress, identify areas for improvement, and make necessary changes to ensure you are on the right path towards achieving your financial goals.

Analyzing Budget Performance

To analyze budget performance, start by comparing your actual income and expenses to what you had budgeted for. Look for any discrepancies and identify the reasons behind them. This analysis will help you understand where your money is going and where adjustments need to be made.

- Compare actual income and expenses to budgeted amounts

- Identify any overspending or underspending

- Analyze the reasons for budget shortfalls or surpluses

- Determine if your financial goals are being met

Making Necessary Changes

Once you have analyzed your budget performance, it’s time to make necessary changes to stay on track. This may involve cutting back on certain expenses, finding ways to increase your income, or reallocating funds to prioritize your financial goals.

- Adjust spending in areas where you are overspending

- Look for opportunities to increase income

- Reallocate funds to focus on important financial goals

- Set new budget targets based on your analysis

Common Reasons for Budget Shortfalls

Budget shortfalls can occur due to a variety of reasons, such as unexpected expenses, overspending, or changes in income. To address budget shortfalls, it’s important to identify the root cause and take corrective action.

- Unexpected emergencies or large expenses

- Overspending on non-essential items

- Decrease in income or loss of a job

- Failure to stick to the budget plan

Tips for Sticking to a Budget

When it comes to sticking to a budget, discipline is key. It’s important to stay focused on your financial goals and avoid unnecessary spending that can throw off your budget. Here are some strategies to help you stay on track:

Handling Unexpected Expenses

Unexpected expenses can easily derail your budget if you’re not prepared. Here are some ways to handle them without compromising your financial plan:

- Build an emergency fund: Set aside a portion of your income each month to create an emergency fund. This will help you cover unforeseen expenses without dipping into your regular budget.

- Prioritize expenses: When unexpected costs arise, prioritize them based on urgency and importance. Cut back on non-essential spending to cover these expenses without blowing your budget.

- Look for alternative sources of income: If you’re faced with a significant unexpected expense, consider taking on extra work or selling items you no longer need to generate additional funds.

Periodic Check-Ins

Regularly reviewing your budget is crucial to ensure you’re staying on track with your financial goals. Here are some reasons why periodic check-ins are important:

- Identify areas of overspending: By reviewing your budget regularly, you can pinpoint where you may be overspending and make adjustments to stay within your financial limits.

- Celebrate milestones: Checking in on your budget allows you to see your progress towards your financial goals. Celebrate small victories to stay motivated and committed to your budget.

- Adapt to changes: Life is unpredictable, and your financial situation may change. Regularly reviewing your budget allows you to adapt to these changes quickly and make necessary adjustments to your spending plan.