Are you ready to tackle the world of tax filing like a pro? Look no further as we dive into the intricacies of filing your taxes, covering everything from understanding the process to maximizing deductions and credits. Get ready to become a tax-filing expert!

From gathering the necessary documents to choosing the right form and avoiding common mistakes, this guide has got you covered every step of the way. Let’s demystify the world of taxes together!

Understanding Tax Filing

When it comes to tax filing, it is the process where individuals report their income and financial information to the government in order to determine how much tax they owe or if they are eligible for a refund.

Types of Taxes Individuals Need to File

- Income Tax: This is the most common type of tax that individuals need to file. It is based on the income earned during the year.

- Property Tax: This tax is based on the value of real estate or personal property owned by an individual.

- Sales Tax: Individuals may need to file sales tax if they have made purchases that are subject to this tax.

Importance of Filing Taxes Accurately and on Time

Filing taxes accurately and on time is crucial to avoid penalties and interest charges. It also ensures that individuals are compliant with the law and avoid any legal issues.

Consequences of Not Filing Taxes

- Penalties: Failure to file taxes can result in penalties imposed by the IRS, which can accumulate over time.

- Interest Charges: Individuals may also be subject to interest charges on any unpaid taxes.

- Legal Action: In severe cases, not filing taxes can lead to legal action by the government, including wage garnishment or property seizure.

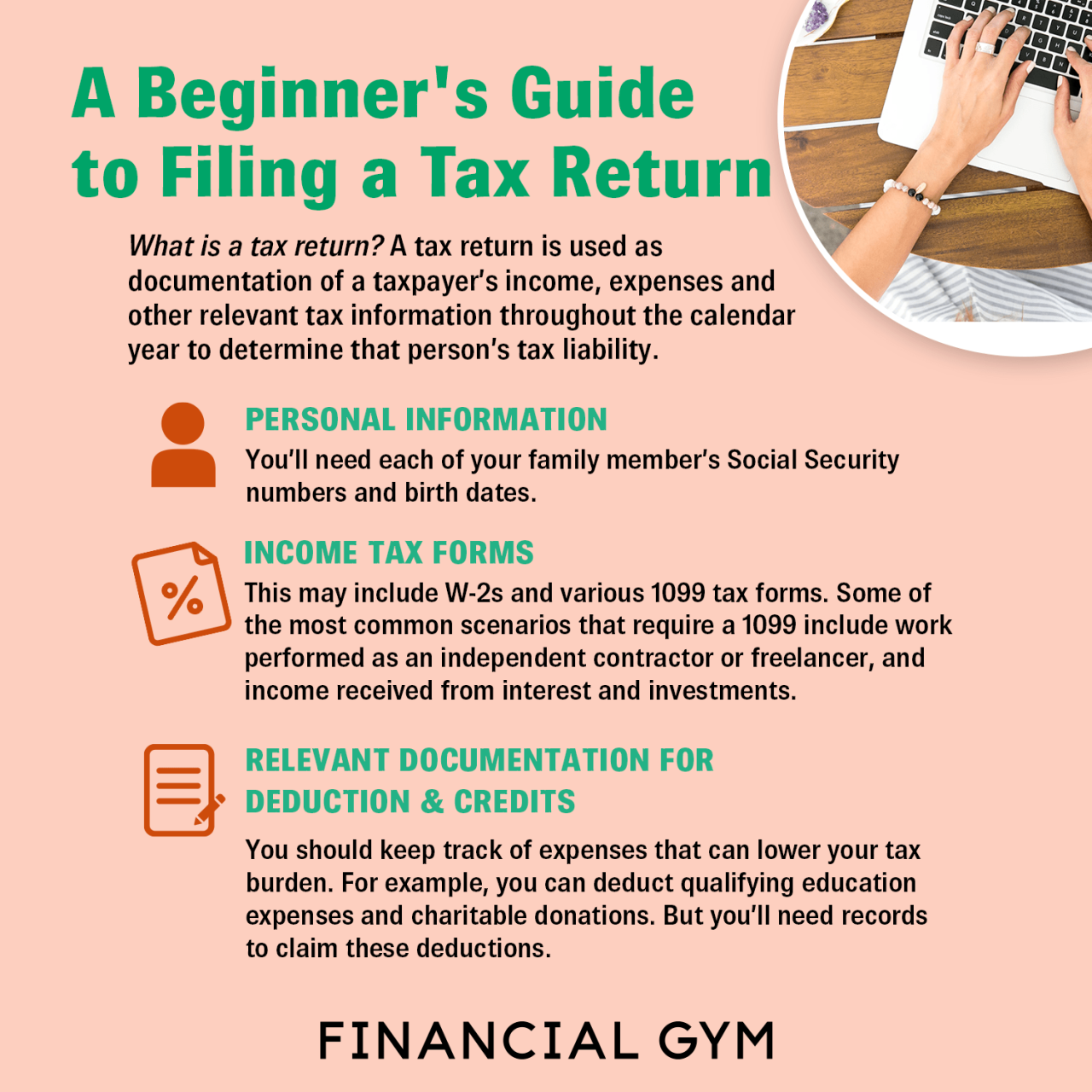

Gathering Required Documents

When it comes to filing your taxes, having all the necessary documents in order is key to a smooth and successful process. Here are some essential documents you’ll need to gather:

W-2 Forms

- Your W-2 form is provided by your employer and Artikels your total earnings and taxes withheld throughout the year. This document is crucial for accurately reporting your income.

1099 Forms

- 1099 forms are typically issued by companies or clients you’ve done contract work for, showing your non-employee income. Make sure to include all 1099 forms when reporting your earnings.

Receipts

- Receipts for deductible expenses, such as medical bills, charitable donations, and business expenses, are essential for reducing your taxable income. Keep all receipts organized and easily accessible.

Organizing and Storing Tips

- Consider creating a designated folder or file for all your tax-related documents to keep everything in one place.

- Label each document clearly and separate them by category (income, deductions, etc.) to streamline the filing process.

- Make digital copies of all your documents as a backup in case the physical copies get lost or damaged.

Requesting Missing Documents

- If you’re missing any essential documents, such as a W-2 form or 1099 form, reach out to the respective employer or institution to request a duplicate. It’s crucial to have all the necessary paperwork before filing your taxes.

Choosing the Right Form

When it comes to filing your taxes, choosing the right form is crucial. Different forms like 1040, 1040A, and 1040EZ cater to different situations, so it’s important to understand which one applies to you.

Comparison of Different Tax Forms

- The 1040 form is the standard form for filing taxes and is suitable for most taxpayers.

- The 1040A form is shorter and simpler than the 1040 form, but has income restrictions.

- The 1040EZ form is the easiest and quickest form to fill out, but has the strictest income requirements.

Eligibility Criteria for Each Form

- To use the 1040 form, you must have income over $100,000 or need to itemize deductions.

- The 1040A form is for individuals with income under $100,000 and who don’t itemize deductions.

- For the 1040EZ form, your income must be under $100,000, and you can’t claim any dependents.

Implications of Selecting the Wrong Form

- If you choose the wrong form, you may face delays in processing your tax return or even penalties for incorrect filing.

- Selecting the right form ensures that you receive any tax credits or deductions you are eligible for.

Where to Find and Download Necessary Forms

- You can find all the necessary tax forms on the official IRS website at www.irs.gov.

- Forms can be downloaded in PDF format for easy printing and filling out.

Filling Out the Tax Form

When it comes to filling out your tax form, accuracy is key to avoid any issues with the IRS. Here’s a step-by-step guide to help you navigate through the process smoothly.

Reporting Income

- Start by entering your income from all sources, including wages, self-employment earnings, interest, dividends, and any other income.

- Make sure to report income accurately to prevent any discrepancies that could trigger an audit.

- Use separate lines for different types of income and follow the instructions provided on the form.

Claiming Deductions

- List all eligible deductions such as student loan interest, mortgage interest, medical expenses, and charitable contributions.

- Ensure you have proper documentation to support your deductions in case of an audit.

- Be aware of the deduction limits and rules to avoid over-claiming deductions.

Applying Credits

- Report any tax credits you qualify for, such as the Earned Income Tax Credit or Child Tax Credit.

- Double-check the eligibility criteria for each credit to make sure you are claiming them correctly.

- Fill out the corresponding forms accurately to claim the credits you are entitled to.

Common Mistakes to Avoid

- Avoid mathematical errors by double-checking all calculations before submitting your tax form.

- Ensure you have entered your personal information correctly, including your Social Security number and filing status.

- Don’t forget to sign and date your tax form before sending it in.

Double-Checking Before Submission

- Review your entire tax form once you have completed it to catch any errors or missing information.

- Consider using tax software or hiring a professional to review your form for accuracy.

- Keep copies of all documents and forms for your records in case you need to refer back to them later.

Understanding Deductions and Credits

When it comes to taxes, understanding deductions and credits can help you save money and reduce your tax bill. Deductions and credits are both ways to lower your taxable income, but they work in slightly different ways. Let’s break it down for you.

Difference Between Deductions and Credits

Deductions are expenses that you can subtract from your taxable income, reducing the amount of income that is subject to tax. On the other hand, tax credits are dollar-for-dollar reductions in the amount of tax you owe. In other words, deductions reduce the amount of income that is taxed, while credits directly reduce the amount of tax you owe.

Common Deductions and Credits

- Common deductions: Some examples of common deductions include student loan interest, mortgage interest, medical expenses, and charitable donations.

- Common credits: Examples of common tax credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits.

How Deductions and Credits Reduce Tax Liability

Deductions and credits can help reduce your tax liability by lowering the amount of income that is subject to tax or by directly reducing the amount of tax you owe. For example, if you have $50,000 in taxable income and $5,000 in deductions, your taxable income would be reduced to $45,000. This means you would pay taxes on $45,000 instead of $50,000. Similarly, if you owe $2,000 in taxes but qualify for a $500 tax credit, your tax bill would be reduced to $1,500.

Claiming Deductions and Credits Correctly

It’s important to keep accurate records of your expenses and income to claim deductions and credits correctly. Make sure to fill out the necessary forms and provide any required documentation to support your claims.