Diving into the world of financial statements, this introduction sets the stage with a fresh and engaging perspective that will keep readers hooked from start to finish.

Get ready to unlock the secrets behind financial statements and gain a deeper understanding of this essential aspect of business.

Overview of Financial Statements

Financial statements are essential tools used by businesses to communicate their financial performance and position to stakeholders. These documents provide a snapshot of a company’s financial health, allowing investors, creditors, and internal management to make informed decisions.

Types of Financial Statements

- Income Statement: Shows a company’s revenues, expenses, and profits over a specific period.

- Balance Sheet: Presents a company’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Details the cash inflows and outflows of a company, highlighting its liquidity.

Importance of Analyzing Financial Statements

Analyzing financial statements is crucial for businesses to evaluate their performance, identify areas of improvement, and make strategic decisions. It helps stakeholders assess the company’s profitability, solvency, and efficiency, guiding them in determining the company’s financial health.

Understanding Balance Sheets

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the difference between the two (equity).

Components of a Balance Sheet

- Assets: These are resources owned by the company, such as cash, inventory, equipment, and investments.

- Liabilities: These are the company’s debts and obligations, including loans, accounts payable, and accrued expenses.

- Equity: This represents the company’s net worth or book value, calculated as assets minus liabilities. It can include common stock, retained earnings, and other components.

Assessing Financial Health

Balance sheets are crucial for evaluating a company’s financial health. By analyzing the relationship between assets, liabilities, and equity, investors, creditors, and other stakeholders can assess the company’s liquidity, solvency, and overall financial stability.

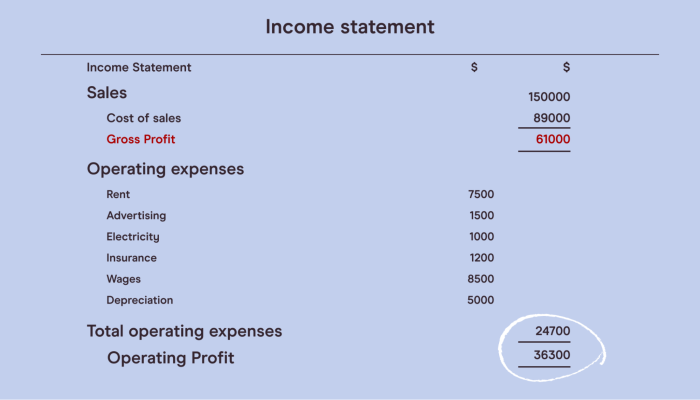

Deciphering Income Statements

Income statements are financial documents that provide a summary of a company’s revenues and expenses over a specific period. They help investors and analysts understand how profitable a company is by showing whether it is generating more money than it is spending.

Key Elements on an Income Statement

- Revenue: The total amount of money a company earns from selling its products or services.

- Expenses: The costs incurred by a company in order to generate revenue, including operating expenses and taxes.

- Net Income: The amount of money left after deducting expenses from revenue, also known as the bottom line.

- Earnings Per Share (EPS): A measure of a company’s profitability that indicates how much money shareholders would receive for each share they own.

How Income Statements Help in Evaluating Profitability

Income statements play a crucial role in assessing a company’s financial health and performance. By analyzing key elements such as revenue, expenses, and net income, investors can determine whether a company is making a profit or experiencing losses. Comparing income statements over different periods can also reveal trends in a company’s profitability and growth potential.

Analyzing Cash Flow Statements

Cash flow statements are crucial financial documents that provide insights into how cash moves in and out of a company over a specific period. They help investors, analysts, and stakeholders understand a company’s ability to generate cash and meet its financial obligations.

Purpose of a Cash Flow Statement

A cash flow statement shows the sources and uses of cash during a specific period, providing a detailed breakdown of operating, investing, and financing activities. It helps assess a company’s ability to generate future cash flows, its liquidity, and solvency.

- Cash flow from operating activities: This section shows the cash generated from the core business operations of the company.

- Cash flow from investing activities: This part Artikels cash flows related to investment activities, such as purchasing or selling assets.

- Cash flow from financing activities: Here, you can find information about cash flows related to financing activities, like issuing or repurchasing stock or debt.

Insights from Cash Flow Statements

Cash flow statements provide valuable insights into a company’s financial health by assessing its liquidity and solvency. By analyzing the cash flow from operating activities, investors can determine if a company is generating enough cash to cover its day-to-day expenses. Cash flow from investing activities helps understand how a company is investing in its future growth or divesting from non-core assets. Lastly, cash flow from financing activities reveals how a company is financing its operations and whether it’s relying on debt or equity to fund its activities.

Interpreting Financial Ratios

Financial ratios are key tools used to analyze a company’s financial health and performance. These ratios help investors, analysts, and other stakeholders assess a company’s profitability, liquidity, solvency, and efficiency. By comparing different ratios, one can gain insights into a company’s strengths and weaknesses, allowing for informed decision-making.

Common Financial Ratios

- Profitability Ratios: These ratios measure a company’s ability to generate profits relative to its revenue, assets, or equity. Examples include:

- Profit Margin: Calculated as net income divided by revenue, this ratio shows how much profit a company generates for each dollar of sales.

- Return on Assets (ROA): Indicates how efficiently a company is using its assets to generate profit.

- Return on Equity (ROE): Measures a company’s ability to generate profit from shareholders’ equity.

- Liquidity Ratios: These ratios assess a company’s ability to meet its short-term obligations. Examples include:

- Current Ratio: Calculated as current assets divided by current liabilities, this ratio indicates a company’s ability to cover its short-term liabilities with its short-term assets.

- Quick Ratio: Also known as the acid-test ratio, this ratio measures a company’s ability to pay off its current liabilities without relying on the sale of inventory.

- Debt Ratios: These ratios evaluate a company’s leverage and solvency. Examples include:

- Debt-to-Equity Ratio: Compares a company’s total debt to its shareholders’ equity, indicating the proportion of financing that comes from debt.

- Interest Coverage Ratio: Shows a company’s ability to cover its interest expenses with its operating income.

Comparing and Benchmarking Companies

Financial ratios are essential for comparing companies within the same industry or sector. By analyzing ratios of similar companies, investors can identify outliers and understand what sets top performers apart from the rest. Benchmarking ratios against industry averages or historical data provides valuable insights into a company’s relative performance and helps in making investment decisions.