Diving into the world of credit scores and loans, this article explores how your credit score can make or break your chances of securing that loan you’ve been eyeing. Get ready to uncover the secrets behind credit scores and their impact on loan approvals.

As we delve deeper into the relationship between credit scores and loan opportunities, you’ll discover the key factors that lenders consider and how you can navigate the lending landscape with confidence.

Understanding Credit Scores

Credit scores play a crucial role in determining an individual’s creditworthiness and their ability to access loans and other financial products. These scores are numerical representations of a person’s credit risk, indicating how likely they are to repay borrowed money based on their financial history.

Calculation of Credit Scores

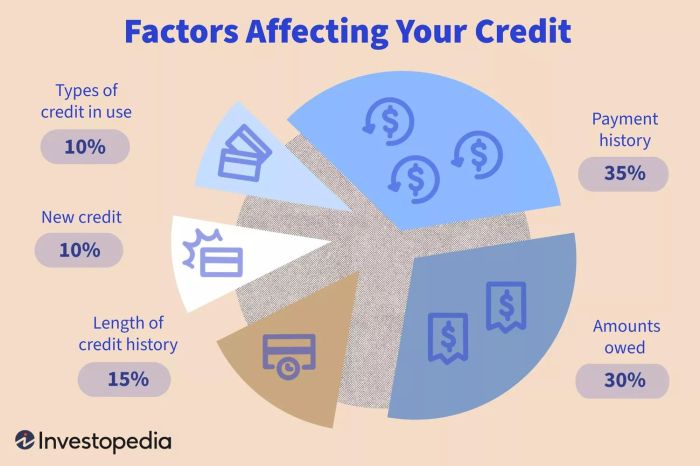

Credit scores are calculated using a variety of factors, including payment history, credit utilization, length of credit history, new credit accounts, and types of credit used. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850, with higher scores indicating lower credit risk.

Key Components of Credit Scores

- Payment History: This accounts for the largest portion of a credit score and reflects whether an individual has made timely payments on their debts.

- Credit Utilization: This factor looks at how much of the available credit a person is using, with lower utilization rates generally seen as more favorable.

- Length of Credit History: The length of time a person has had credit accounts open can impact their credit score, with longer histories typically viewed more positively.

- New Credit Accounts: Opening multiple new credit accounts in a short period can negatively impact a credit score, as it may suggest financial instability.

- Types of Credit Used: Having a mix of credit accounts, such as credit cards, mortgages, and auto loans, can positively impact a credit score by showing responsible credit management.

Importance of Credit Scores in Lending

Credit scores are crucial in the lending industry as they help lenders assess the risk of extending credit to individuals. A higher credit score typically results in better loan terms, such as lower interest rates and higher borrowing limits. On the other hand, lower credit scores may lead to loan denials or higher interest rates to compensate for the increased risk.

Range of Credit Scores and Loan Approvals

A credit score of 300 to 579 is considered very poor, 580 to 669 is fair, 670 to 739 is good, 740 to 799 is very good, and 800 to 850 is exceptional.

- Very Poor to Fair: Individuals with credit scores in this range may struggle to qualify for loans or may face higher interest rates and stricter terms.

- Good to Very Good: Those with credit scores in this range are likely to qualify for loans with favorable terms and lower interest rates.

- Exceptional: Individuals with exceptional credit scores have the best chances of loan approval and may qualify for the most competitive loan offers.

Impact of Credit Scores on Loan Approval

Having a good credit score can significantly impact your ability to secure loans and the terms you receive. Lenders use credit scores to evaluate the risk of lending money to individuals, making it crucial to maintain a positive credit history.

Credit Scores Influence Loan Approval

- Credit scores play a critical role in the approval process for different types of loans, including mortgages, auto loans, and personal loans.

- Lenders often have minimum credit score requirements for loan approval, with higher scores typically leading to a higher chance of approval.

Good Credit Score Leads to Better Loan Terms

- Individuals with good credit scores are more likely to qualify for loans with lower interest rates and favorable terms.

- Lower interest rates can result in significant savings over the life of a loan, making it essential to maintain a good credit score.

Credit Scores Determine Interest Rates

- Credit scores directly impact the interest rates offered by lenders, with higher scores leading to lower interest rates.

- A higher credit score demonstrates financial responsibility, reducing the perceived risk for lenders and resulting in better loan terms.

Credit Scores Affect Borrower’s Ability to Secure Loans

- Individuals with low credit scores may struggle to secure loans or may only qualify for loans with high-interest rates and unfavorable terms.

- Improving your credit score over time can increase your chances of loan approval and access to better loan options.

Credit Score Ranges and Loan Options

When it comes to credit scores and loan options, the range of your credit score can significantly impact the type of loans you qualify for and the terms you receive. Let’s explore how credit score ranges influence loan eligibility and borrowing opportunities.

Impact of Poor Credit Score

Having a poor credit score, typically below 580, can severely limit your loan options. Individuals with poor credit scores may struggle to qualify for traditional loans and may have to resort to secured loans with higher interest rates.

Impact of Fair Credit Score

Individuals with fair credit scores, ranging from 580 to 669, may have more loan options available to them compared to those with poor credit scores. However, they may still face higher interest rates and stricter terms.

Impact of Good Credit Score

With a good credit score, typically ranging from 670 to 739, borrowers have access to a wider range of loan options with more favorable terms. They are likely to qualify for unsecured loans with lower interest rates.

Impact of Excellent Credit Score

Individuals with excellent credit scores, usually above 740, have the most favorable loan options available to them. They can qualify for the best interest rates and terms on unsecured loans, giving them significant borrowing power.

Improving Credit Scores for Better Loan Opportunities

Maintaining a good credit score is crucial for securing favorable loan terms and increasing the chances of loan approval. By implementing certain strategies, individuals can improve their credit scores and open up better loan opportunities.

Pay Bills on Time

One of the most effective ways to improve your credit score is to pay your bills on time. Late payments can have a negative impact on your credit score, so make sure to prioritize timely payments for all your bills, including credit card payments, utilities, and loans.

Reduce Credit Card Balances

High credit card balances can negatively affect your credit score. Aim to keep your credit card balances low and pay off any outstanding debts to improve your credit utilization ratio. This can show lenders that you are responsible with your credit.

Monitor Your Credit Report

Regularly monitoring your credit report can help you identify any errors or discrepancies that could be dragging down your credit score. By staying on top of your credit report, you can take steps to correct any inaccuracies and improve your overall credit score.

Limit New Credit Applications

Applying for multiple new lines of credit within a short period can signal to lenders that you are in financial distress. Limit the number of new credit applications you submit to avoid potential negative impacts on your credit score. Be strategic and only apply for credit when necessary.

Build a Positive Credit History

Establishing a positive credit history by using credit responsibly over time can help improve your credit score. Make consistent, on-time payments, keep your credit balances low, and avoid closing old accounts to demonstrate to lenders that you are a reliable borrower.