Diving deep into the world of Personal loan options, get ready to explore the ins and outs of this financial landscape in a way that’s fresh, engaging, and totally rad.

In the following paragraphs, we’ll break down the different types of personal loans, compare secured vs. unsecured options, and provide tips for choosing the best one for your needs.

Personal Loan Options

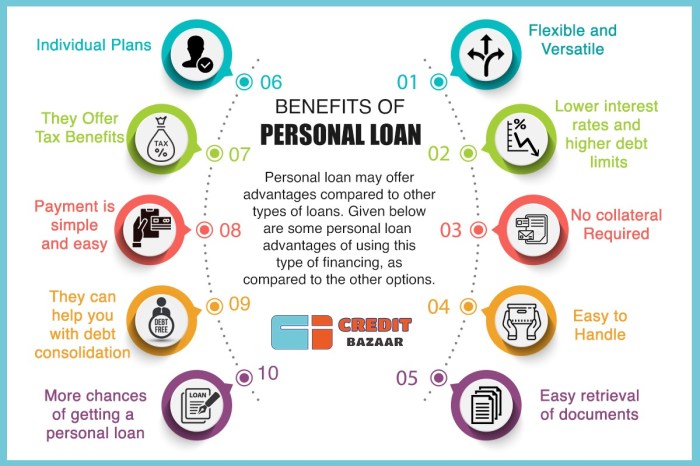

When it comes to personal loans, there are various options available to suit different financial needs and situations. Personal loans are typically unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses.

Types of Personal Loan Options

- Traditional Personal Loans: These are standard unsecured loans that are offered by banks, credit unions, and online lenders. They usually have fixed interest rates and repayment terms.

- Peer-to-Peer Loans: These loans involve borrowing money from individuals or investors through online platforms. The terms and rates can vary depending on the lender.

- Secured Personal Loans: These loans require collateral, such as a car or savings account, to secure the loan. They often have lower interest rates compared to unsecured loans.

- Debt Consolidation Loans: These loans are specifically designed to combine multiple debts into one single loan with a lower interest rate. They can help simplify debt repayment.

Secured vs. Unsecured Personal Loans

Secured personal loans require collateral to secure the loan, which can be repossessed if the borrower fails to repay. Unsecured personal loans, on the other hand, do not require collateral but typically have higher interest rates to compensate for the increased risk to the lender.

Factors to Consider When Choosing a Personal Loan

- Interest Rate: Compare interest rates from different lenders to find the best deal.

- Repayment Terms: Consider the length of the loan and monthly payments that fit your budget.

- Fees: Be aware of any origination fees, prepayment penalties, or other charges associated with the loan.

- Credit Score: Your credit score will impact the interest rate you receive, so it’s important to know where you stand.

- Loan Amount: Make sure the loan amount meets your financial needs without borrowing more than necessary.

Interest Rates and Fees

When it comes to personal loans, understanding the ins and outs of interest rates and fees is crucial to making informed financial decisions.

How Interest Rates are Calculated

Interest rates for personal loans are typically calculated based on the borrower’s creditworthiness and the lender’s evaluation of risk. The lower the credit risk, the lower the interest rate offered.

Common Fees Associated with Personal Loans

- Origination fees

- Late payment fees

- Prepayment penalties

Impact of Credit Scores on Interest Rates

Your credit score plays a significant role in determining the interest rate you are offered for a personal loan. A higher credit score usually results in a lower interest rate, while a lower credit score may lead to a higher interest rate.

Strategies for Obtaining the Best Interest Rates

- Improve your credit score by paying bills on time and reducing debt.

- Shop around and compare offers from different lenders.

- Consider a co-signer with a strong credit history to potentially secure a lower interest rate.

Application Process

When applying for a personal loan, there are several steps involved in the process. From gathering necessary documentation to the approval and funding timeline, here’s what you need to know.

Documentation Required

- Proof of identity (such as a driver’s license or passport)

- Proof of income (pay stubs, tax returns, or bank statements)

- Proof of residence (utility bills or lease agreements)

- Credit history (credit report or score)

Loan Approval Process

- Once you submit your application and required documents, the lender will review your information.

- The lender will assess your creditworthiness, income stability, and debt-to-income ratio to determine approval.

- If approved, you will receive a loan offer outlining the terms and conditions.

- You may need to provide additional documentation or information during the approval process.

Timeline for Receiving Funds

- After loan approval, funds are typically disbursed within a few business days.

- Some lenders offer same-day funding options for an additional fee.

- Once funds are disbursed, you can use them for any purpose Artikeld in the loan agreement.

Repayment Options

When it comes to repaying your personal loan, there are several options available to help you manage your payments effectively. It’s important to understand the different repayment plans, consequences of defaulting, and how to pay off your loan early.

Types of Repayment Plans

- Standard Repayment Plan: This is the most common option where you make fixed monthly payments over a set period of time until the loan is fully repaid.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income, making it more manageable during times of financial difficulty.

- Graduated Repayment Plan: Payments start low and increase over time, typically every two years. This can be beneficial if you expect your income to rise in the future.

Consequences of Defaulting

- Damage to Credit Score: Missing payments or defaulting on your loan can significantly impact your credit score, making it harder to borrow in the future.

- Increased Interest and Fees: Defaulting can lead to increased interest rates, fees, and even legal action by the lender to recover the debt.

- Potential Asset Seizure: In some cases, lenders may seize assets or take legal action to recover the outstanding debt.

Paying Off Your Loan Early

It’s important to check with your lender to ensure there are no prepayment penalties before making extra payments to pay off your loan early.

- Make Extra Payments: By making additional payments towards your principal balance, you can reduce the overall interest paid and shorten the loan term.

- Refinance: If you’re able to secure a lower interest rate, consider refinancing your loan to save on interest costs and pay it off sooner.

Tips for Managing Repayments

- Create a Budget: Track your expenses and income to ensure you can afford your loan payments each month.

- Set up Automatic Payments: Avoid missing payments by setting up automatic withdrawals from your bank account.

- Contact Your Lender: If you’re facing financial hardship, contact your lender to discuss alternative repayment options or forbearance.