Diving into the world of credit reports, this article is your ultimate guide to understanding the ins and outs of this crucial financial tool. From deciphering credit scores to unraveling the impact on your financial health, we’ve got you covered. So, buckle up and get ready to demystify the realm of credit reports.

Now, let’s delve deeper into the components that make up a credit report and how they play a pivotal role in shaping your financial future.

Importance of Credit Reports

Credit reports play a crucial role in determining an individual’s financial health. They provide a detailed overview of a person’s credit history, including their payment history, credit utilization, and types of credit accounts.

Impact on Credit Scores

- Credit reports directly influence credit scores, which are numerical representations of a person’s creditworthiness.

- Positive information on credit reports, such as timely payments and low credit utilization, can lead to higher credit scores.

- On the other hand, negative factors like late payments or high levels of debt can result in lower credit scores.

Usage by Lenders, Employers, and Landlords

- Lenders: Financial institutions use credit reports to assess an individual’s credit risk when applying for loans or credit cards. A strong credit report can lead to better loan terms and lower interest rates.

- Employers: Some employers may request credit reports as part of the hiring process, especially for positions that involve handling finances. A positive credit report can reflect positively on a job applicant’s reliability and responsibility.

- Landlords: Landlords often review credit reports when considering rental applications. A good credit report can increase the chances of securing a lease, while a poor credit report may lead to higher security deposits or even rejection of the application.

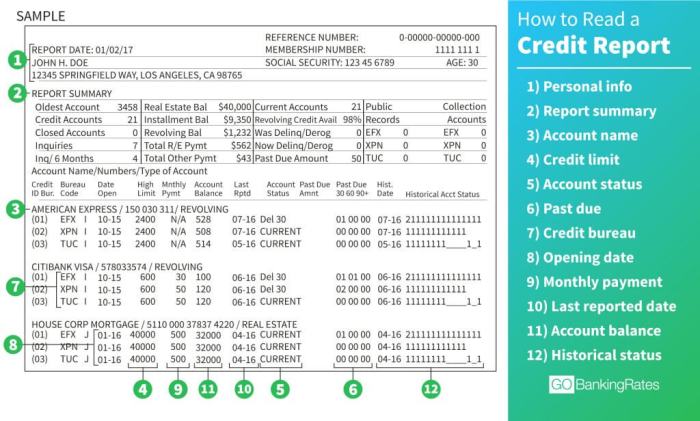

Components of a Credit Report

When looking at a credit report, there are several key elements that play a crucial role in determining an individual’s creditworthiness. These components provide valuable information to lenders and creditors about a person’s financial history and responsibility.

Personal Information

- Includes details such as name, address, social security number, and date of birth.

- Ensures accuracy and verifies the identity of the individual.

- Incorrect personal information can lead to issues with credit applications.

Account History

- Lists all credit accounts, including credit cards, loans, and mortgages.

- Shows payment history, balances, and credit limits.

- Helps assess how well an individual manages their debts and payments.

Inquiries

- Records all instances when someone requests to view the credit report.

- Hard inquiries impact credit scores while soft inquiries do not.

- Multiple inquiries within a short period can indicate financial distress.

Significance of Components

Understanding each component helps lenders evaluate the risk associated with extending credit to an individual.

Credit Reports vs. Credit Scores

- Credit reports provide detailed information about an individual’s credit history, while credit scores condense this data into a numerical value.

- Credit reports are used to generate credit scores, which are crucial in determining creditworthiness.

- Both are essential in assessing financial health and eligibility for credit.

Obtaining a Credit Report

To access your credit report, there are various ways you can obtain it. It is crucial to regularly review your credit report to ensure accuracy and monitor any suspicious activities. Understanding how to interpret the information in your credit report is essential for maintaining good credit health.

Different Ways to Access a Credit Report

- Annual Credit Report: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) once a year through AnnualCreditReport.com.

- Credit Monitoring Services: Signing up for credit monitoring services can provide you with regular access to your credit report and alerts for any changes or suspicious activity.

Importance of Reviewing Credit Reports Regularly

Regularly reviewing your credit report allows you to:

- Check for errors or inaccuracies that could negatively impact your credit score.

- Monitor for any signs of identity theft or fraudulent activity.

- Track your credit utilization and payment history to maintain good credit health.

Tips on Interpreting Information in a Credit Report

- Review Personal Information: Ensure all personal details are accurate and up to date.

- Check Account Information: Verify all accounts listed, including balances, payment history, and any derogatory marks.

- Understand Credit Scores: Pay attention to your credit score and factors affecting it, such as payment history, credit utilization, and length of credit history.

- Look for Inquiries: Monitor inquiries made on your credit report, as excessive inquiries can negatively impact your score.

Factors Affecting Credit Reports

When it comes to credit reports, there are several key factors that can have a significant impact on your overall credit standing. Understanding these factors is crucial in managing and improving your credit report over time.

Missed Payments:

One of the most common factors that can negatively affect your credit report is missed payments. When you fail to make payments on time or skip payments altogether, it can lower your credit score and signal to lenders that you may be a risky borrower.

High Credit Utilization:

Another factor that can impact your credit report is high credit utilization. This occurs when you use a large percentage of your available credit limit. Lenders may view high credit utilization as a sign that you are overextended financially, which can lower your credit score.

Errors on Credit Reports:

Errors on credit reports can also have a negative impact on your credit standing. It’s important to regularly review your credit report for any inaccuracies and dispute any errors you find. By correcting these errors, you can improve your credit report and potentially raise your credit score.

Improving Credit Reports:

To improve your credit report over time, consider implementing the following strategies:

– Pay your bills on time to establish a positive payment history.

– Keep your credit card balances low to maintain a healthy credit utilization ratio.

– Regularly monitor your credit report and address any errors promptly.

– Consider opening new credit accounts responsibly to diversify your credit mix.

– Avoid closing old credit accounts, as this can shorten your credit history and potentially lower your credit score.

By being proactive and mindful of these factors, you can work towards building a stronger credit report and improving your overall financial health.