Understanding financial ratios sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Dive into the world of financial analysis with a hip twist that makes even the most complex ratios seem like a piece of cake.

Introduction to Financial Ratios

Financial ratios are tools used in financial analysis to evaluate a company’s performance by comparing different numerical values taken from financial statements. These ratios provide insights into various aspects of a company’s financial health and help stakeholders make informed decisions.

Importance of Financial Ratios

Financial ratios play a crucial role in assessing a company’s financial performance and health. They help in identifying trends, comparing performance against industry benchmarks, and highlighting strengths and weaknesses. By analyzing these ratios, investors, creditors, and management can gauge the company’s profitability, liquidity, efficiency, and solvency.

- Profitability Ratios: These ratios measure the company’s ability to generate profits relative to its revenue, assets, or equity. Examples include:

Return on Investment (ROI) = Net Profit / Total Assets

Profit Margin = Net Income / Revenue

- Liquidity Ratios: These ratios assess the company’s ability to meet short-term obligations. Examples include:

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

- Efficiency Ratios: These ratios measure how effectively a company utilizes its assets and liabilities. Examples include:

Asset Turnover Ratio = Revenue / Total Assets

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

- Solvency Ratios: These ratios indicate the company’s ability to meet long-term obligations. Examples include:

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

Interest Coverage Ratio = EBIT / Interest Expense

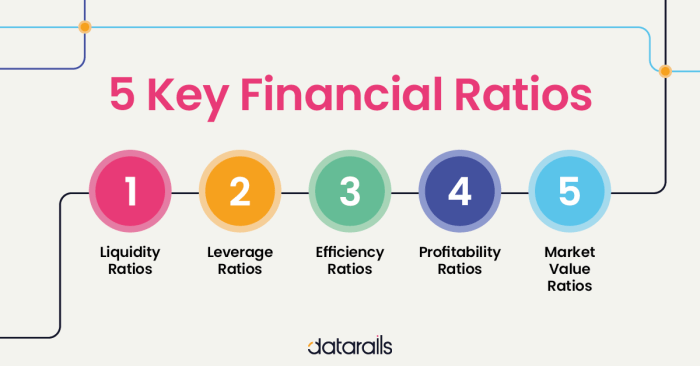

Types of Financial Ratios

Financial ratios are categorized into four main types: liquidity, profitability, solvency, and efficiency. Each type of financial ratio provides valuable insights into different aspects of a company’s financial health.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet short-term obligations. They include:

- Current Ratio: Calculated by dividing current assets by current liabilities. A ratio above 1 indicates the company can cover its short-term debts.

- Quick Ratio: Also known as the Acid-Test Ratio, it measures the company’s ability to pay off its current liabilities without relying on the sale of inventory.

Profitability Ratios

Profitability ratios evaluate a company’s ability to generate profits. Examples include:

- Profit Margin: Calculated by dividing net income by total revenue, this ratio shows how much profit a company makes for every dollar of sales.

- Return on Equity (ROE): Indicates how efficiently a company is using its shareholders’ equity to generate profits.

Solvency Ratios

Solvency ratios measure a company’s ability to meet its long-term obligations. Examples include:

- Debt-to-Equity Ratio: Compares a company’s total debt to its shareholders’ equity, reflecting the company’s reliance on debt financing.

- Interest Coverage Ratio: Shows the company’s ability to meet interest payments on outstanding debt.

Efficiency Ratios

Efficiency ratios assess how well a company utilizes its assets and liabilities. Examples include:

- Inventory Turnover: Measures how many times a company sells and replaces its inventory within a specific period.

- Accounts Receivable Turnover: Indicates how efficiently a company collects payments from its customers.

How to Calculate Financial Ratios

To calculate financial ratios, you need to follow specific formulas and analyze financial statements accurately. Let’s break down the process step by step to understand how it’s done.

Basic Formula for Calculating Financial Ratios

Financial Ratio = (Amount A / Amount B)

- Identify the financial data needed for the specific ratio you want to calculate.

- Apply the formula by dividing the relevant amounts to get the ratio.

- Repeat the process for each financial ratio you want to analyze.

Analyzing Financial Statements for Ratio Calculation

Financial Ratio = (Amount A / Amount B)

- Gather the financial statements, including the income statement, balance sheet, and cash flow statement.

- Extract the necessary figures such as revenue, expenses, assets, and liabilities.

- Plug the data into the formula to calculate the ratios.

Significance of Accurate Data Input

- Accurate financial data is crucial for precise ratio calculations.

- Even small errors in input numbers can lead to significant discrepancies in the ratios.

- Ensure the data is up to date and correctly entered to obtain reliable financial ratios.

Interpreting Financial Ratios

Financial ratios are essential tools used to analyze a company’s financial health and performance. Interpreting these ratios involves understanding what different values indicate about a company’s financial situation.

Comparing Financial Ratios

When comparing financial ratios across different time periods or with industry benchmarks, it is important to consider the context in which the ratios are being analyzed. Significant changes in ratios may indicate shifts in the company’s financial health, efficiency, or profitability.

- For example, an increase in the debt-to-equity ratio over time may suggest that the company is taking on more debt to finance its operations, which could lead to increased financial risk.

- Conversely, a decrease in the return on assets ratio may indicate that the company’s assets are not generating as much profit as before, which could be a cause for concern.

Implications on Investment Decisions

Understanding the implications of varying financial ratios is crucial for making informed investment decisions. Investors use financial ratios to assess the financial health and performance of a company before deciding to invest.

For instance, a high current ratio may signal that a company is well-positioned to cover its short-term liabilities, making it a more attractive investment option.

- On the other hand, a low profit margin ratio may indicate that the company is struggling to generate profits from its operations, which could deter potential investors.

- By analyzing different financial ratios in conjunction with other factors, investors can gain valuable insights into a company’s financial standing and make strategic investment decisions.

Limitations of Financial Ratios

Financial ratios are valuable tools for analyzing a company’s financial health, but they do have limitations that need to be considered.

One major limitation is that financial ratios only provide a snapshot of a company’s performance at a specific point in time. They may not reflect the overall trends or changes in the company’s financial situation over time.

Reliance on Historical Data

Financial ratios rely on historical financial data, which may not accurately represent the current or future financial position of a company. Changes in market conditions, business strategies, or economic factors may not be reflected in historical ratios.

- Financial ratios may not account for potential future changes in the industry or market that could impact the company’s performance.

- Using only historical data may not capture sudden shifts or disruptions in the business environment that could affect the company’s financial health.

Subjectivity and Comparability

Interpreting financial ratios can be subjective and may vary depending on the industry or company size. Comparing ratios across different industries or companies can be challenging due to varying accounting methods and business models.

It is important to consider industry benchmarks and peer comparisons when analyzing financial ratios to ensure a more accurate assessment of a company’s performance.

Non-Financial Factors

Financial ratios do not take into account non-financial factors that could impact a company’s overall success, such as management quality, brand reputation, or customer satisfaction. These factors are crucial in evaluating a company’s long-term sustainability and growth potential.

- Complementary methods like SWOT analysis, market research, or qualitative assessments can provide a more holistic view of a company’s performance beyond financial ratios.

- Using multiple financial metrics in conjunction with ratios can help mitigate the limitations and provide a more comprehensive analysis of a company’s financial health.